Setup and Master Data Maintenance Copy

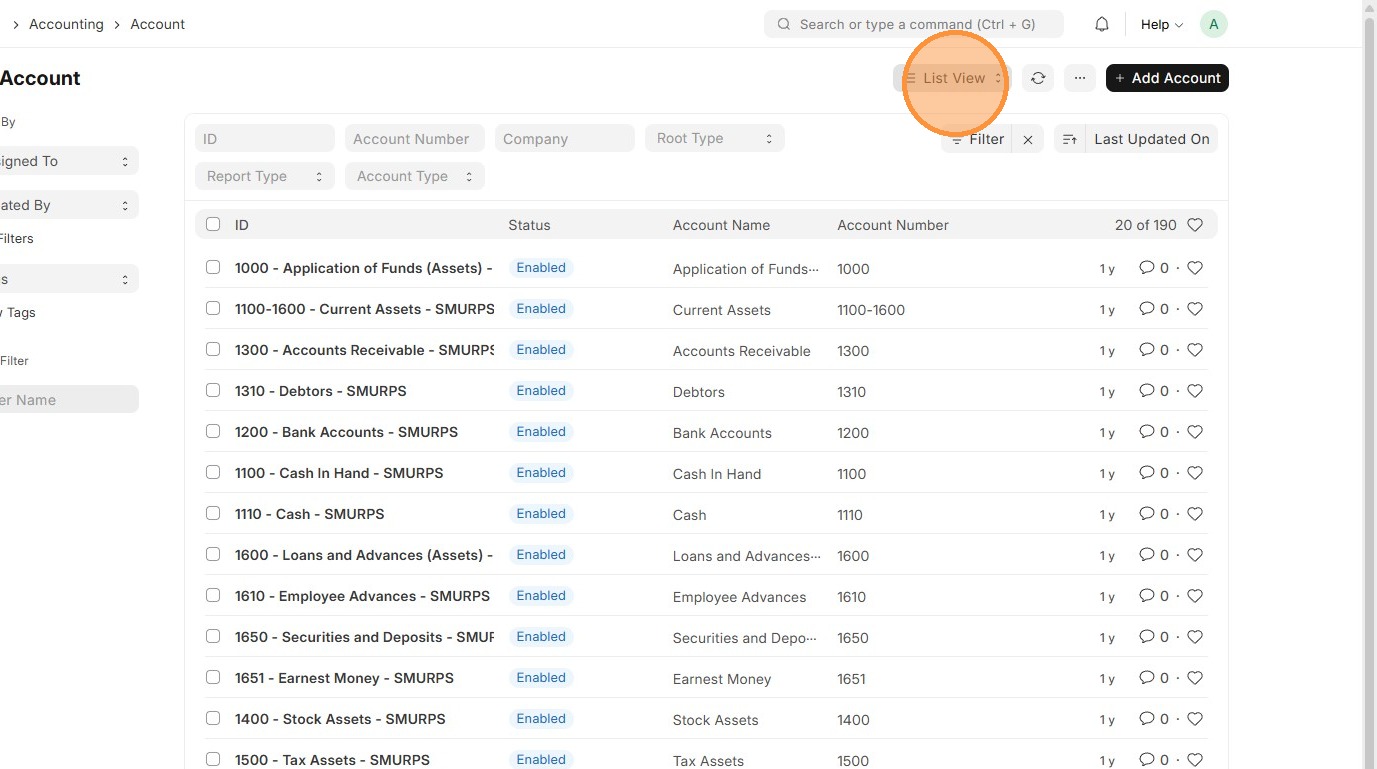

Chart of Accounts

The Chart of Accounts is like the backbone of your accounting system. It’s a list of all the accounts where money in your business is tracked what you earn, what you spend, and what you own. Every sale, purchase, or expense gets recorded into these accounts, so at any time, you can review how much money you have, how much you owe, and how much you’ve earned.

Chart of Accounts

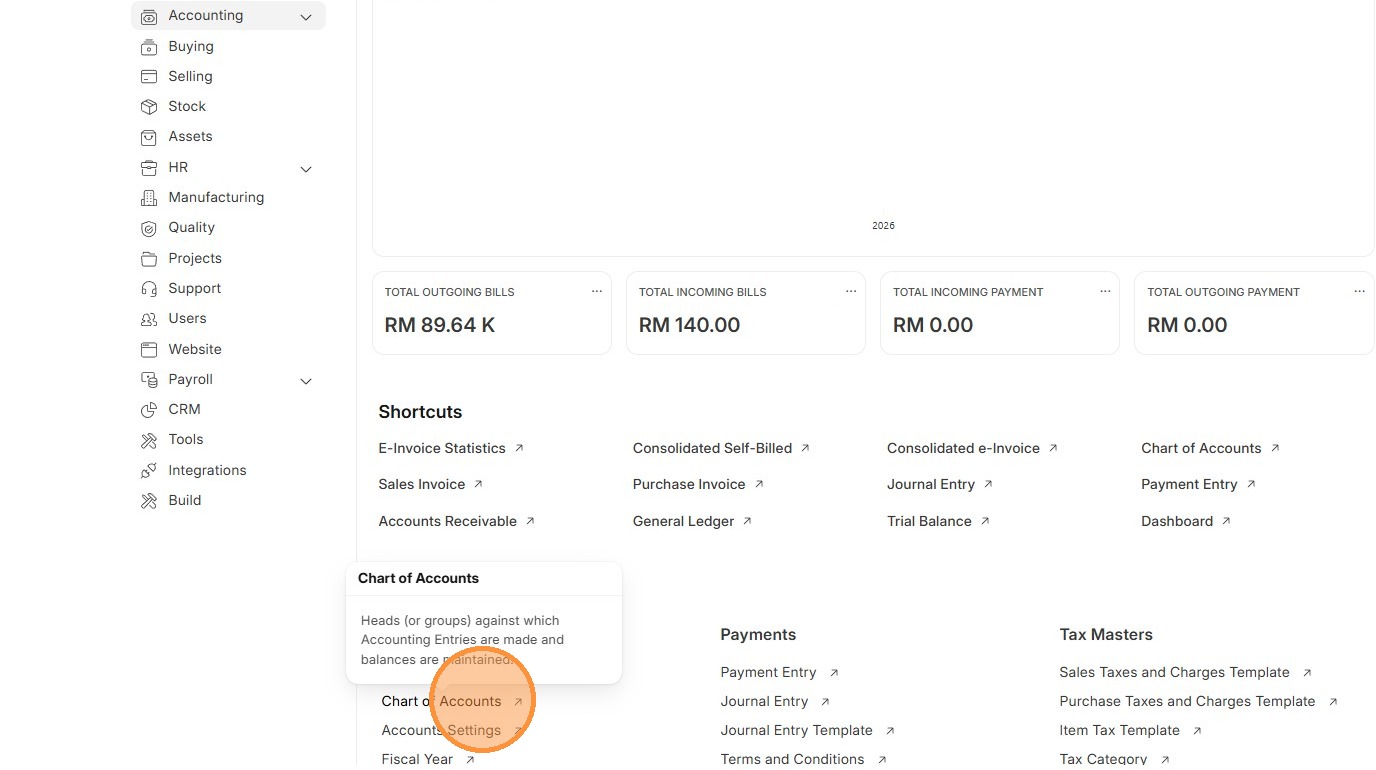

2. Click "Chart of Accounts"

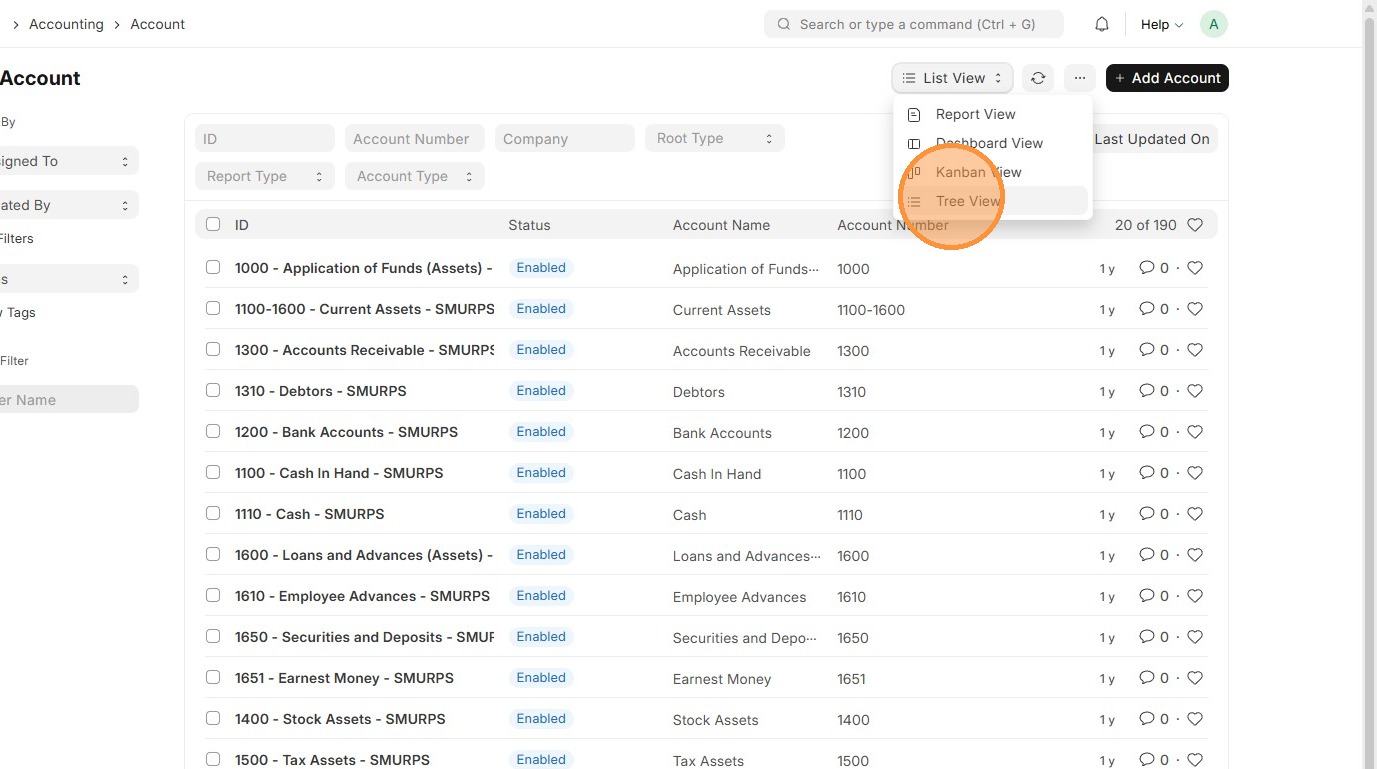

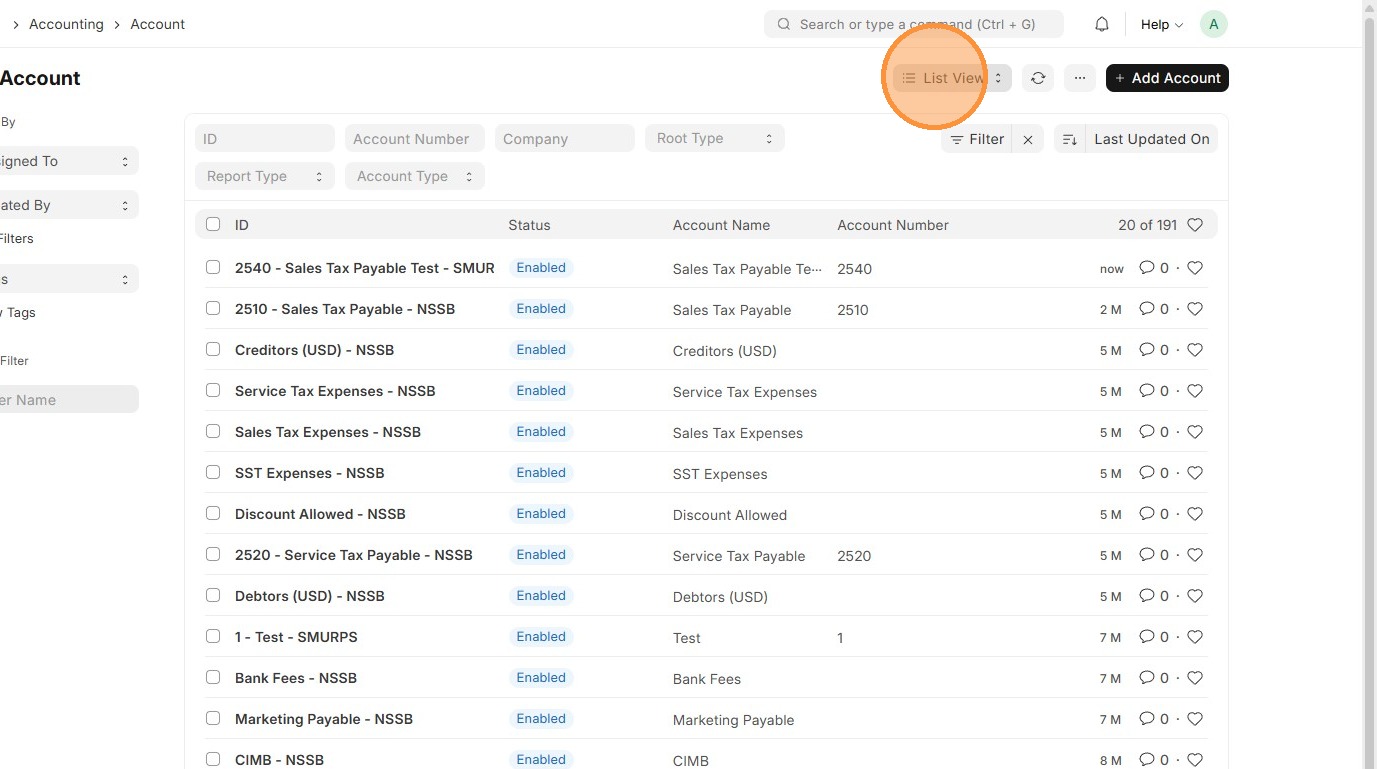

3. Click "List View"

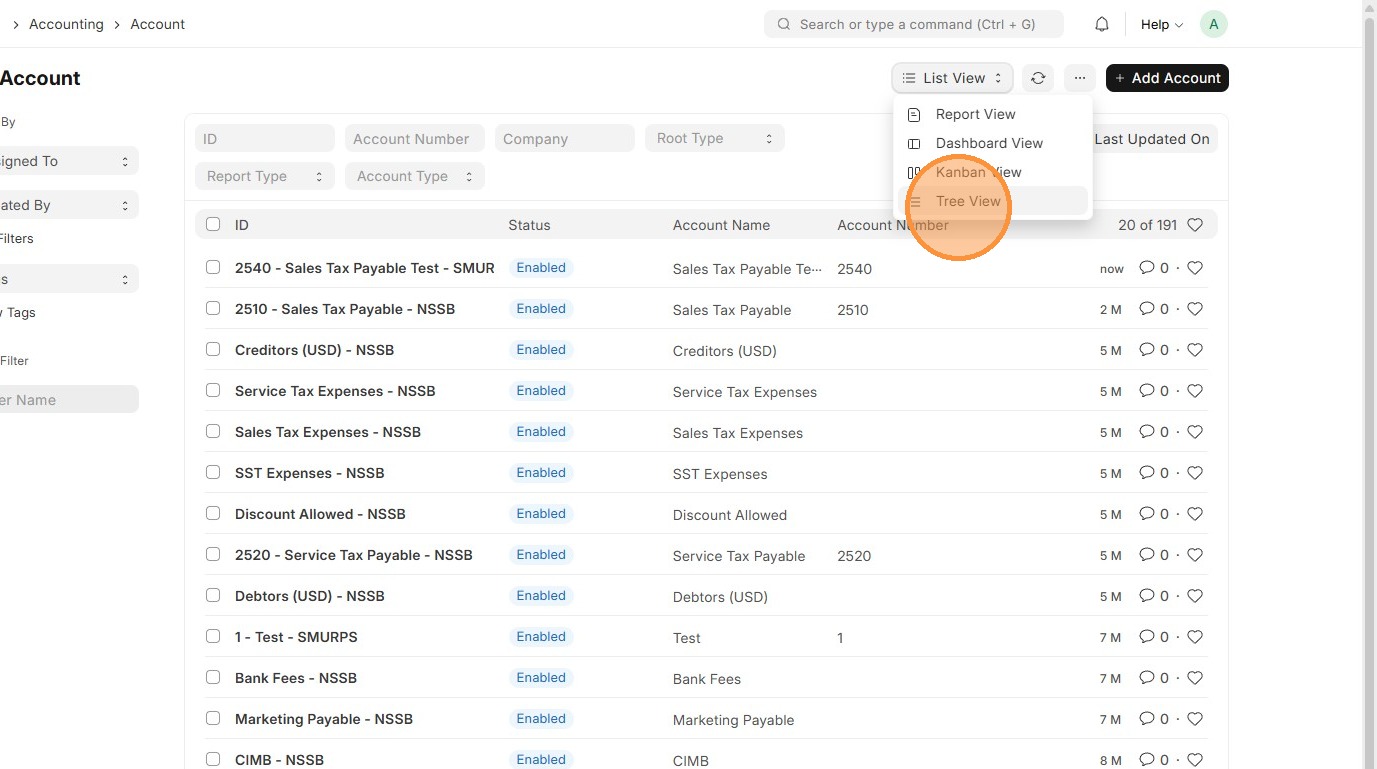

4. Click "Tree View"

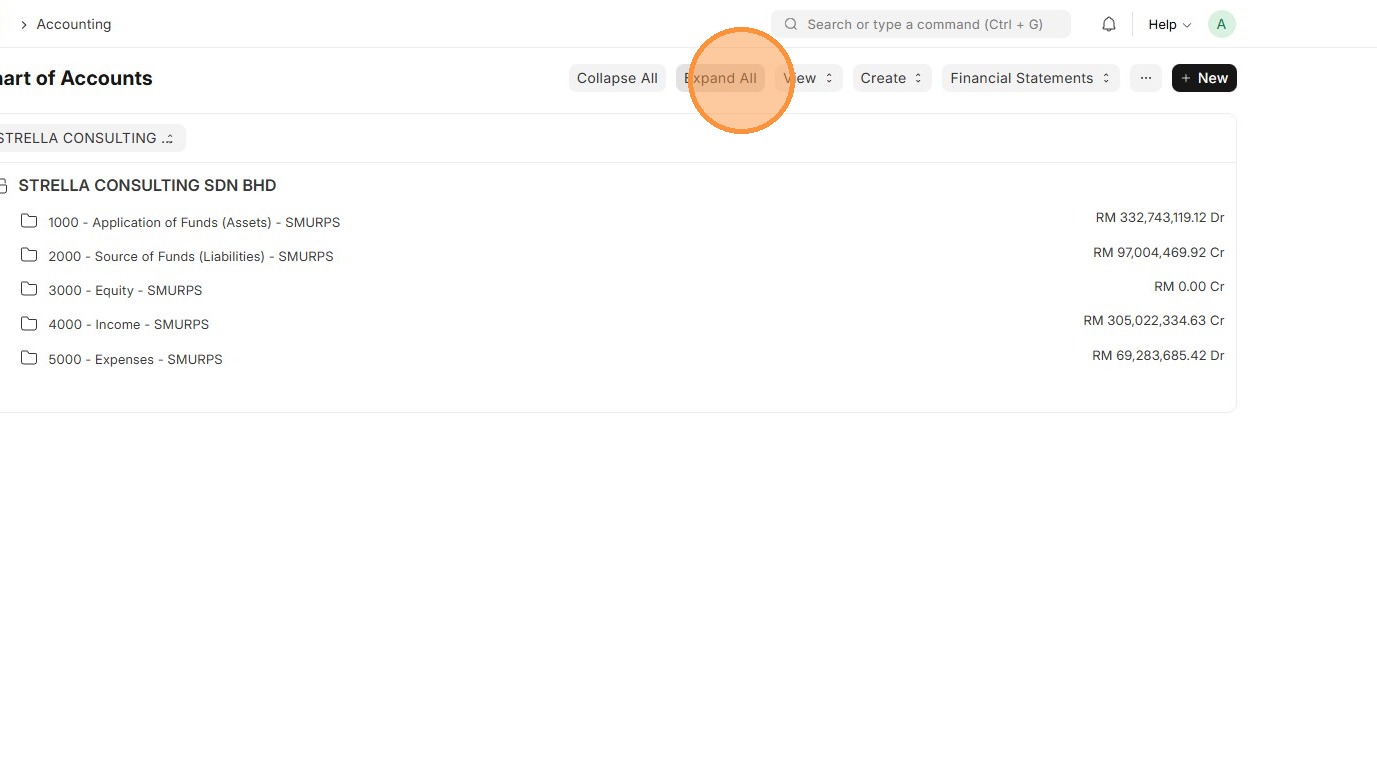

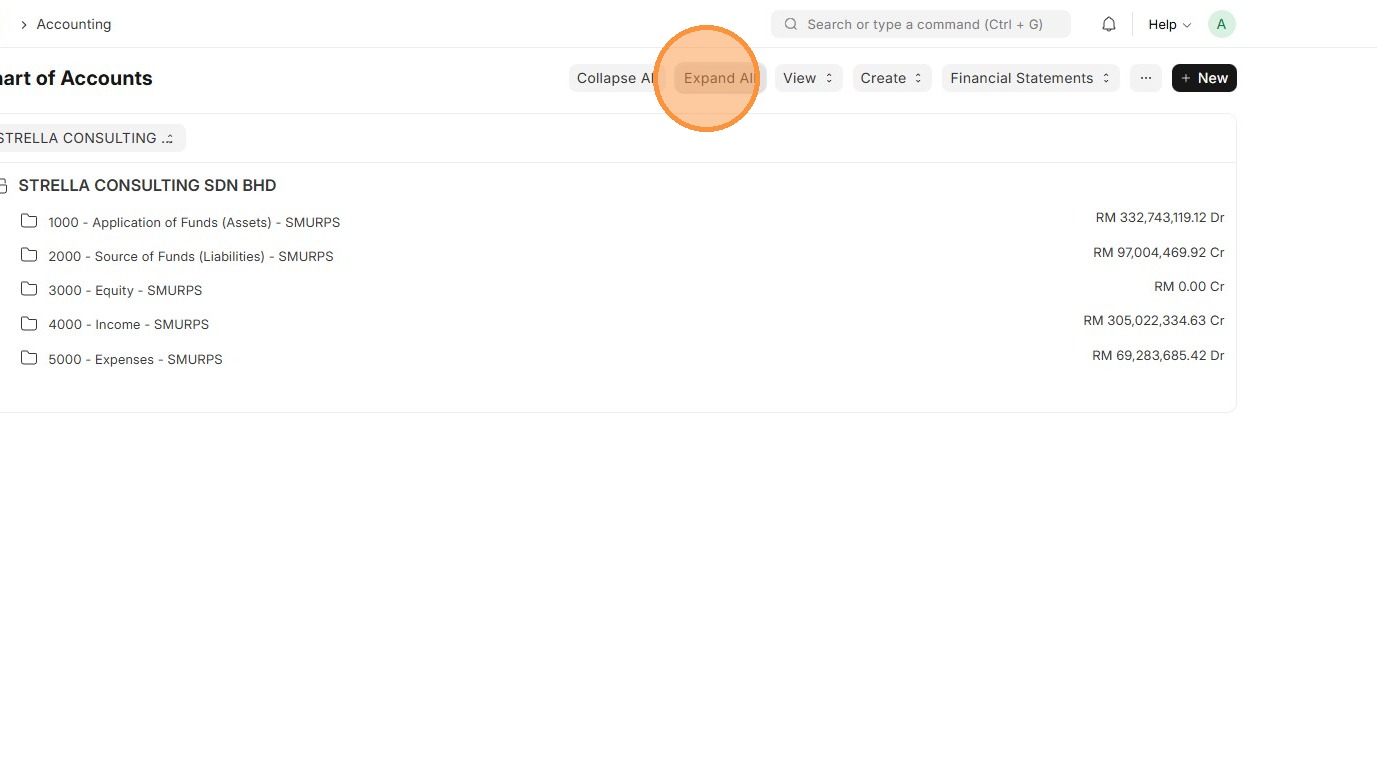

5. Click "Expand All"

6. Review the Charts of Account structure before creating a new COA.

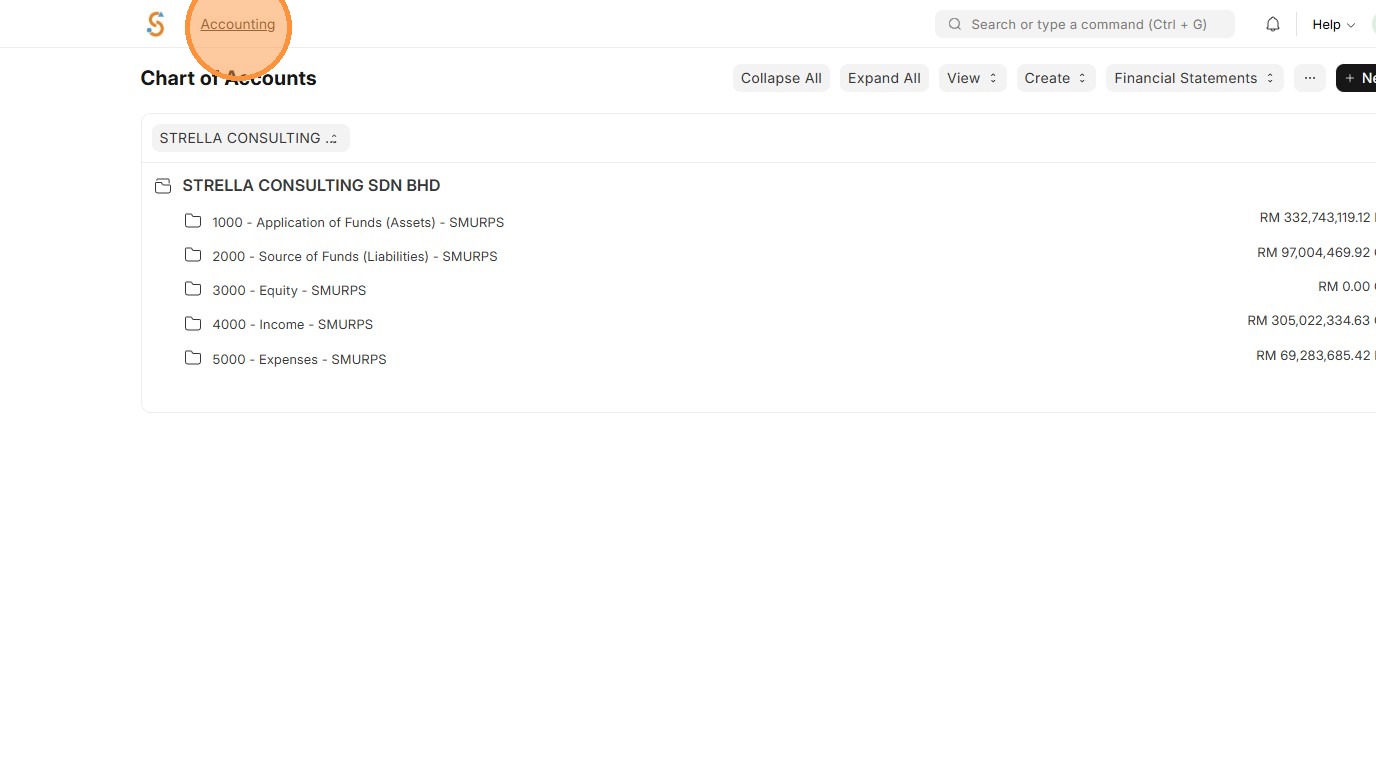

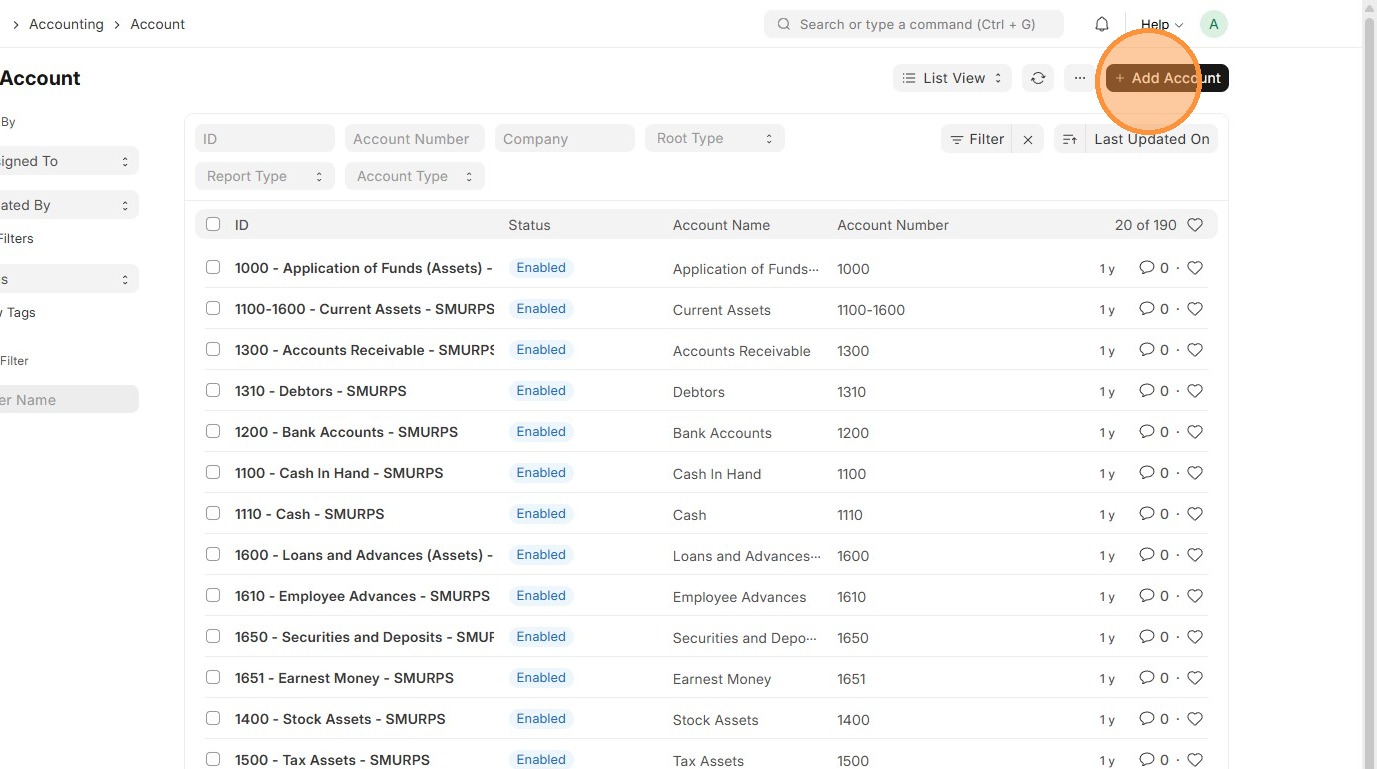

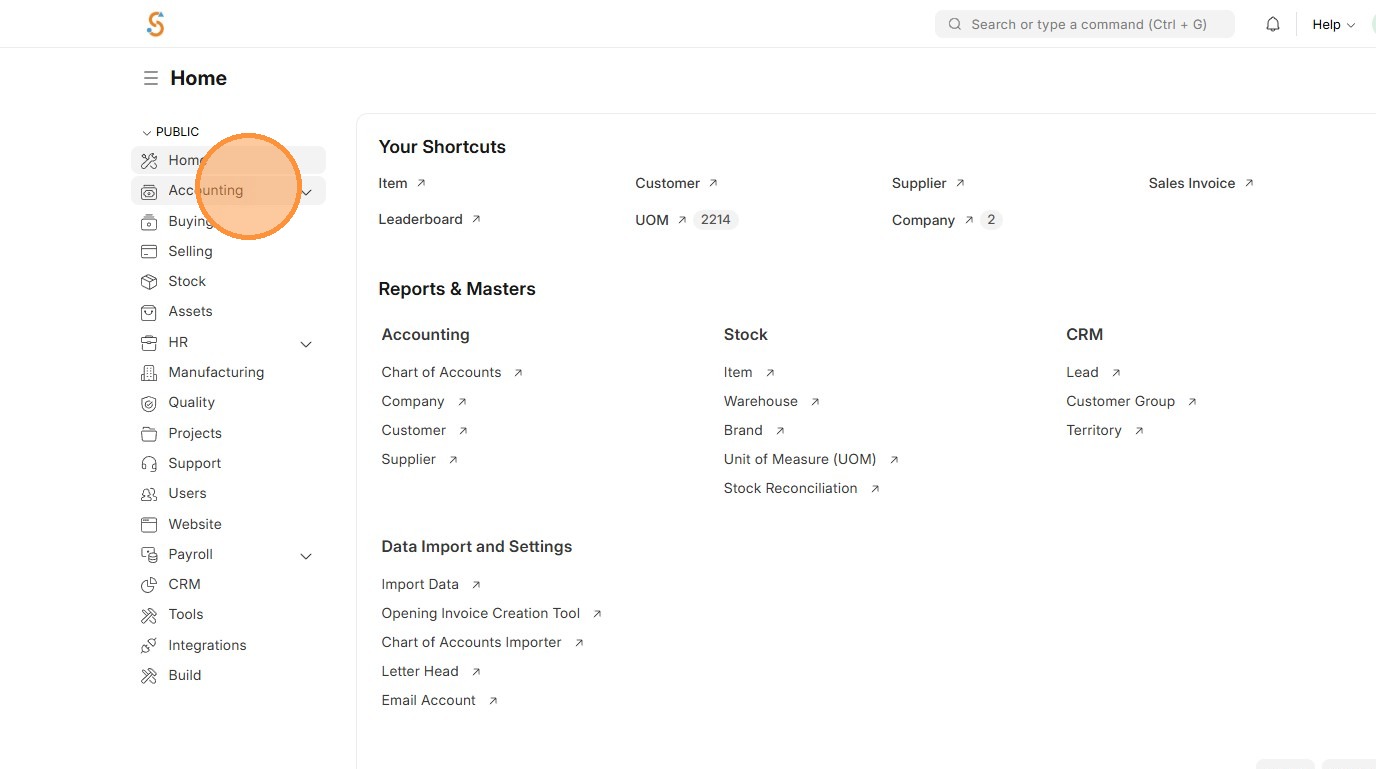

7. Click "Accounting"

8. Click "Chart of Accounts"

9. Click "Add Account"

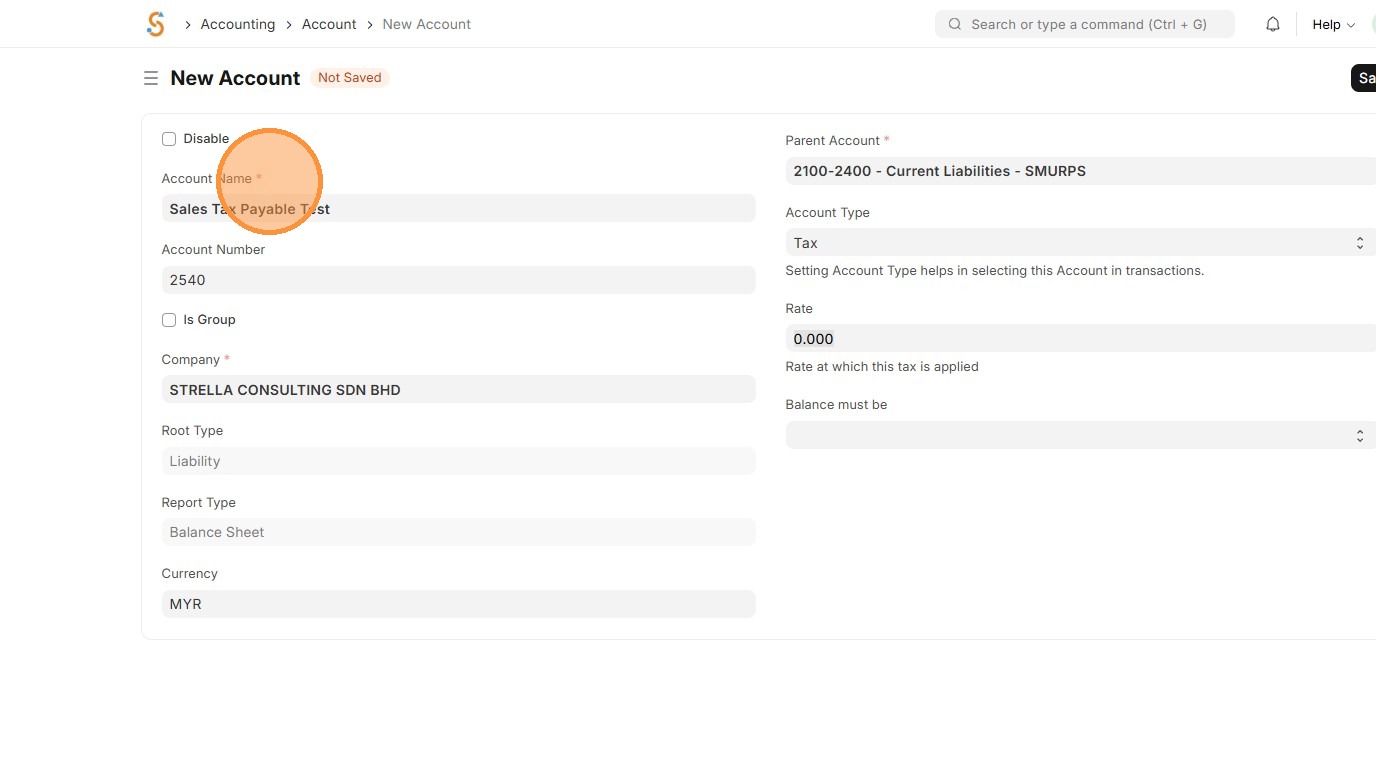

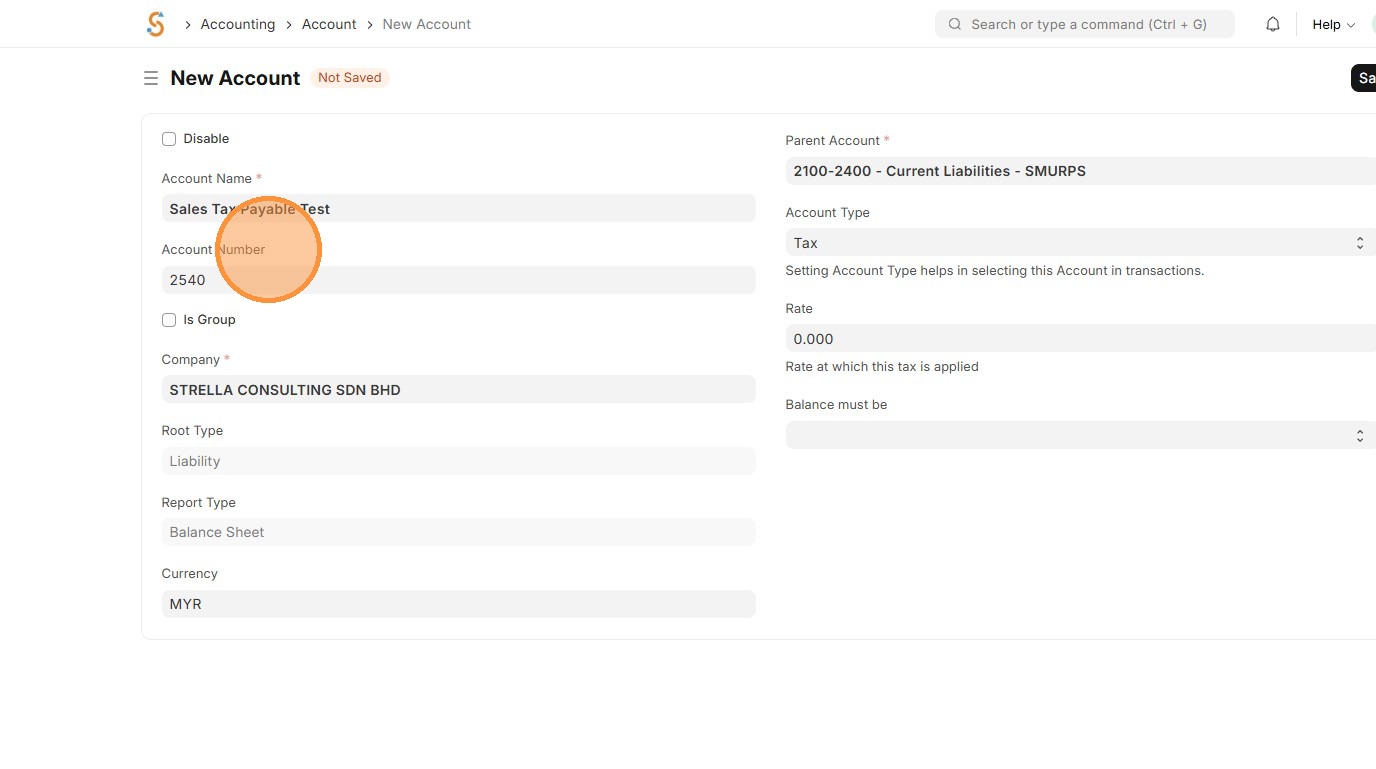

10. Enter "Account Name"

11. Enter "Account Number" and Tick 'Is Group' only if Account is Parent Group

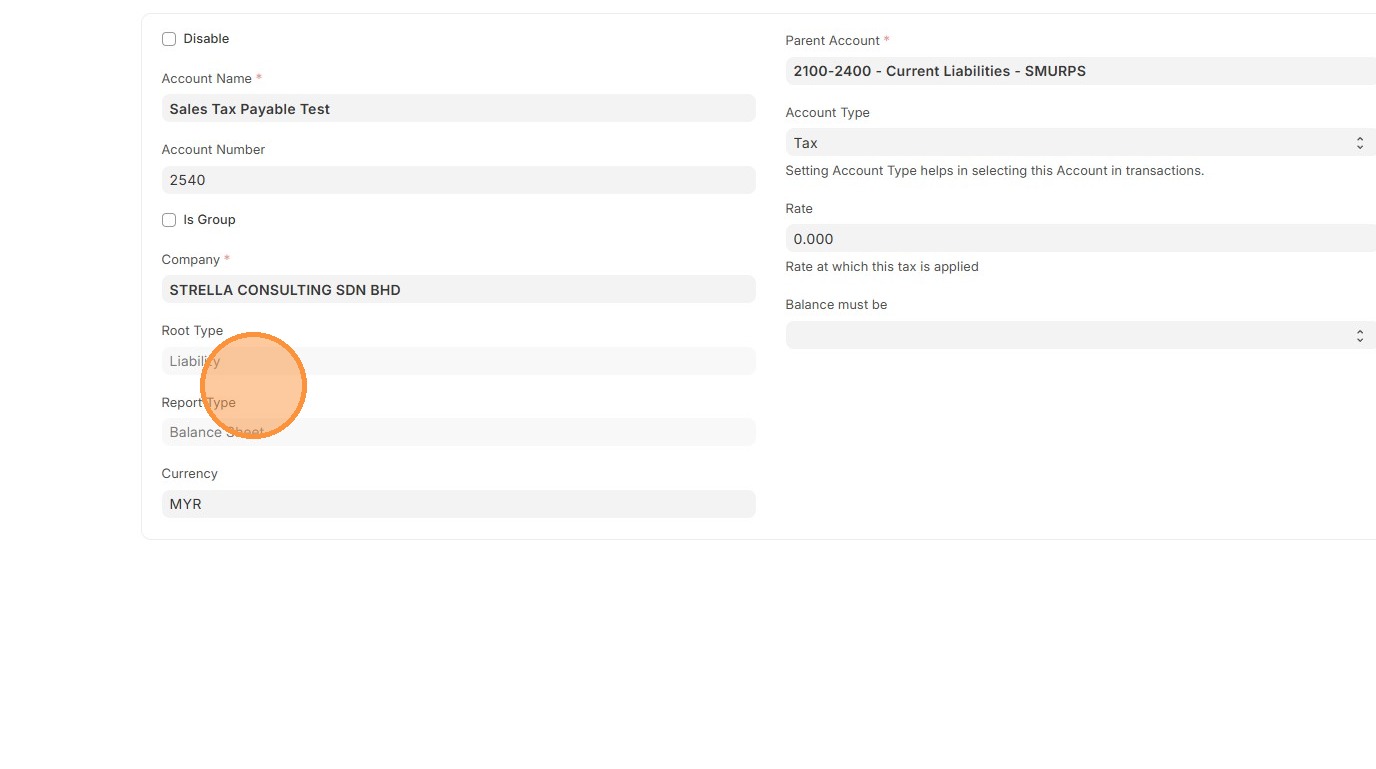

12. Review the Root Type, Report Type and Currency.

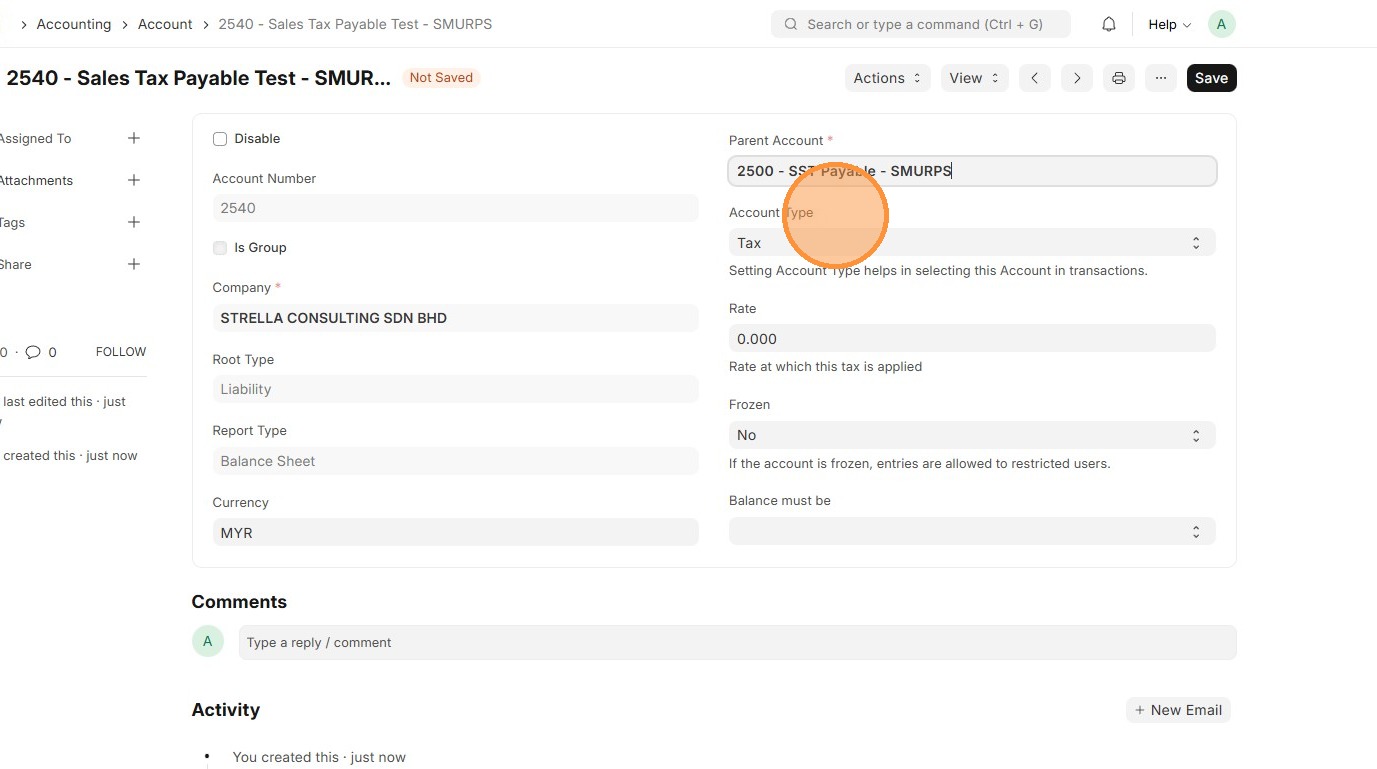

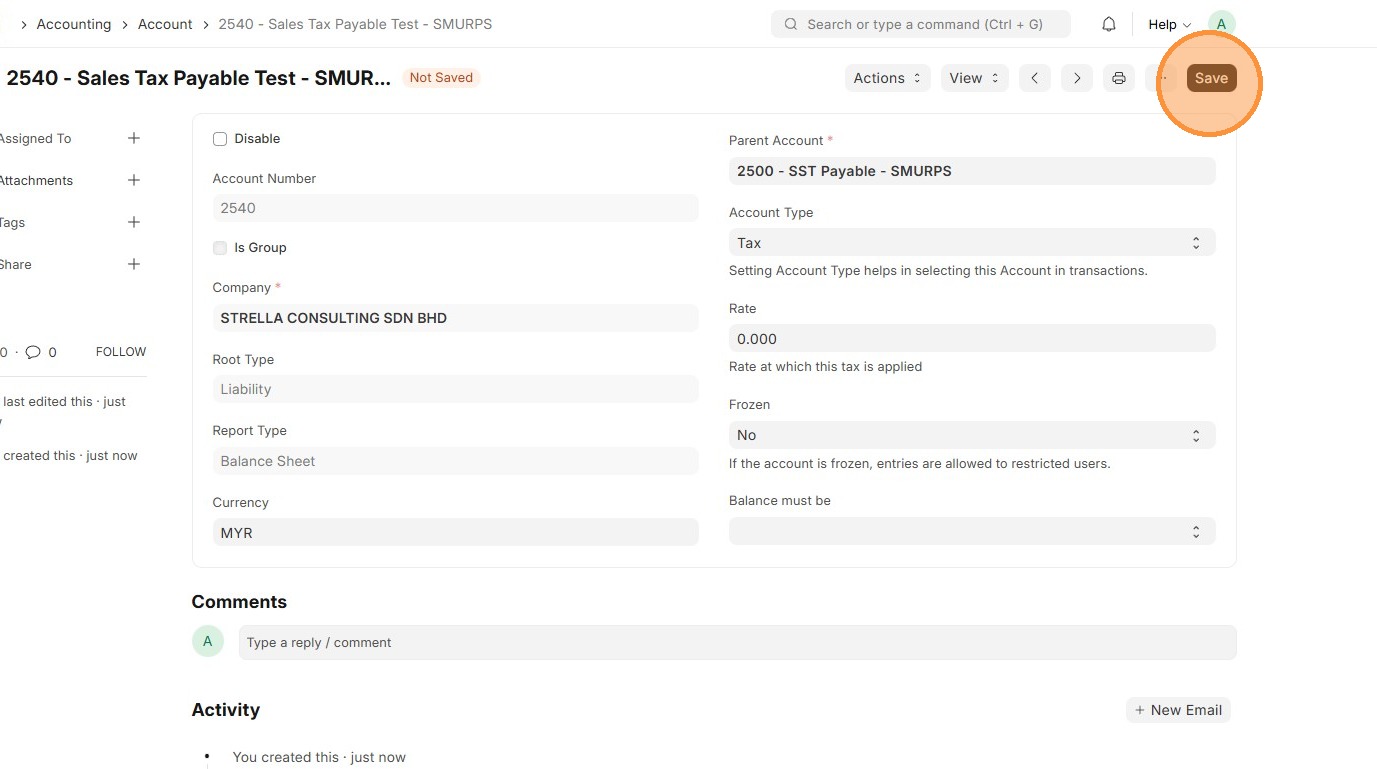

13. Select "Parent Account" and "Account Type" based on Account objective.

14. Click "Save"

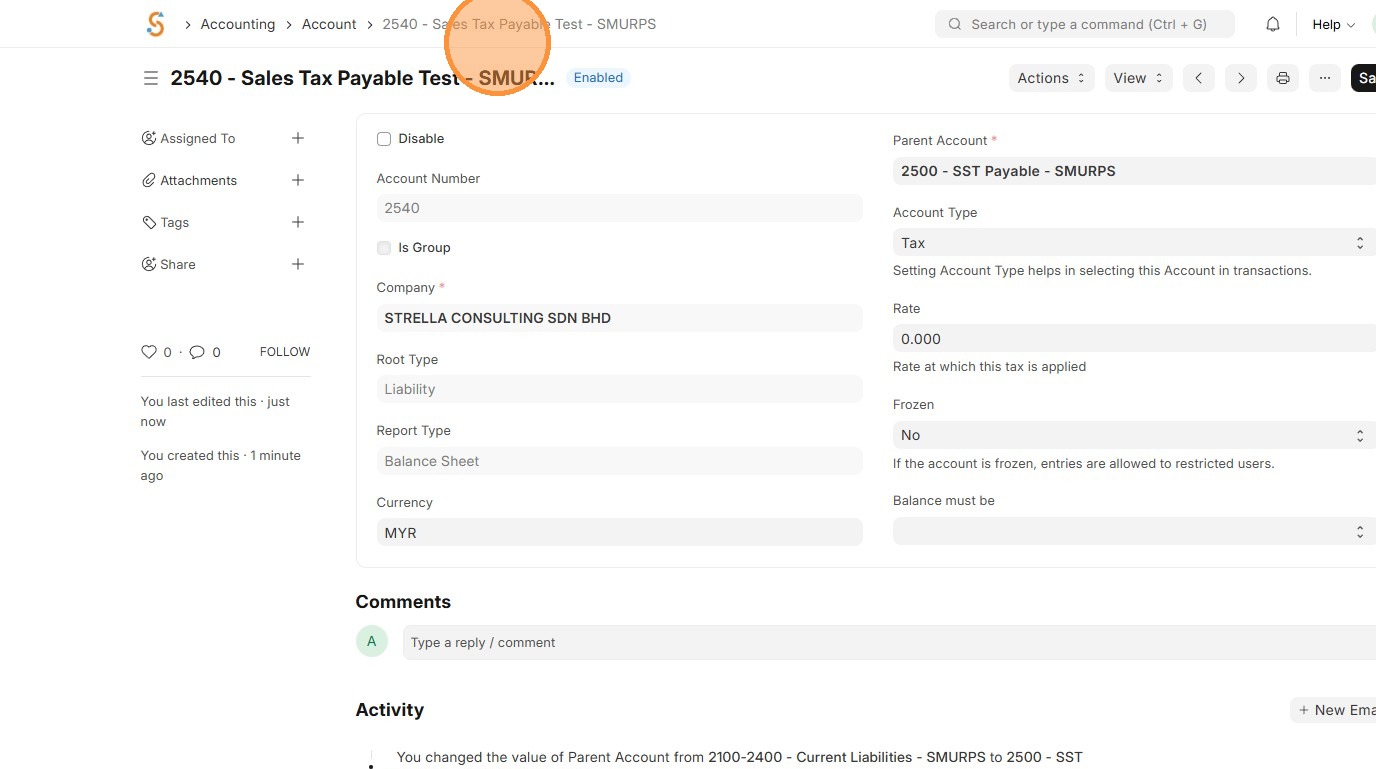

15. Review that Account ID is created.

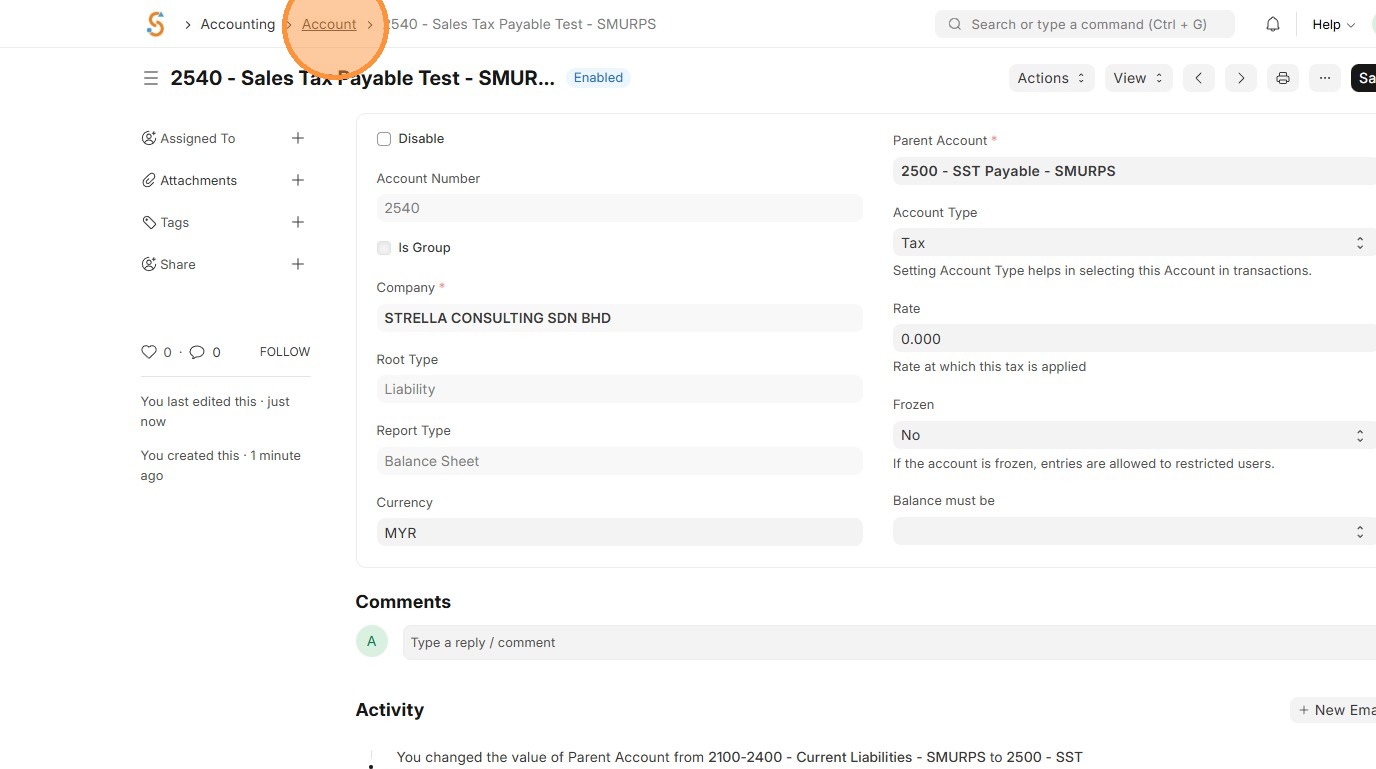

16. Click "Account"

17. Click "List View"

18. Click "Tree View"

19. Click "Expand All"

20. Verify that Account newly created is linked to correct Parent Account.

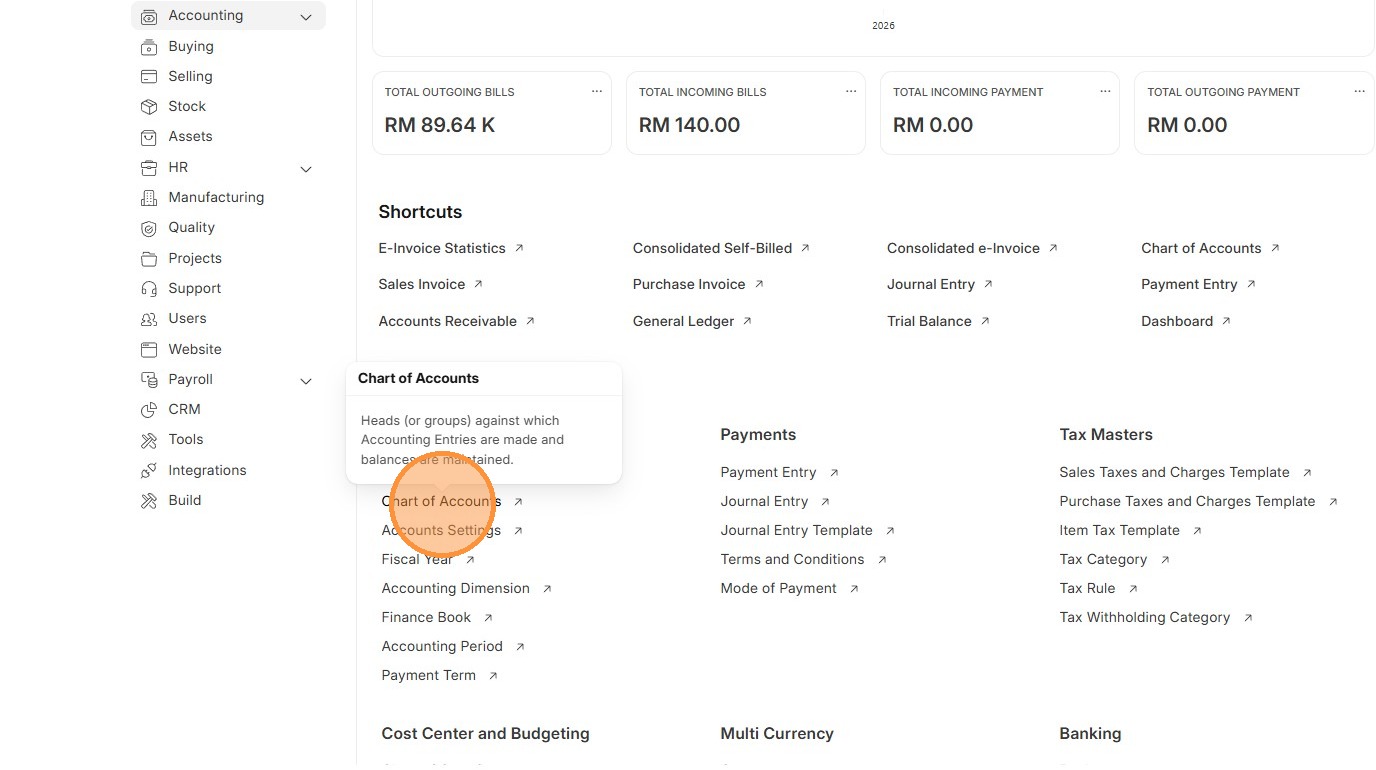

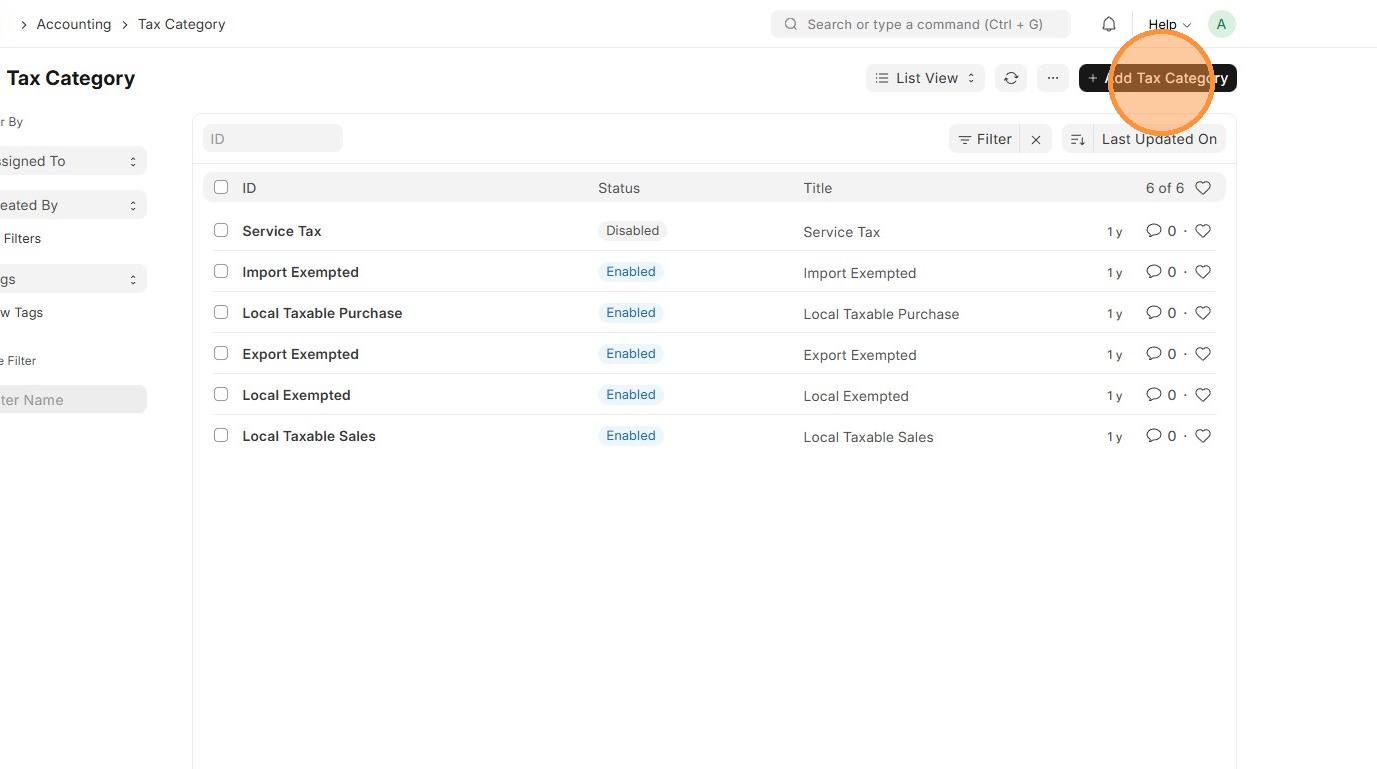

Tax Category

A Tax Category groups taxes like GST, VAT, or Exempt so the system knows which tax to apply automatically to items, customers, or suppliers. It also makes reporting and compliance easier by showing totals for each tax type..

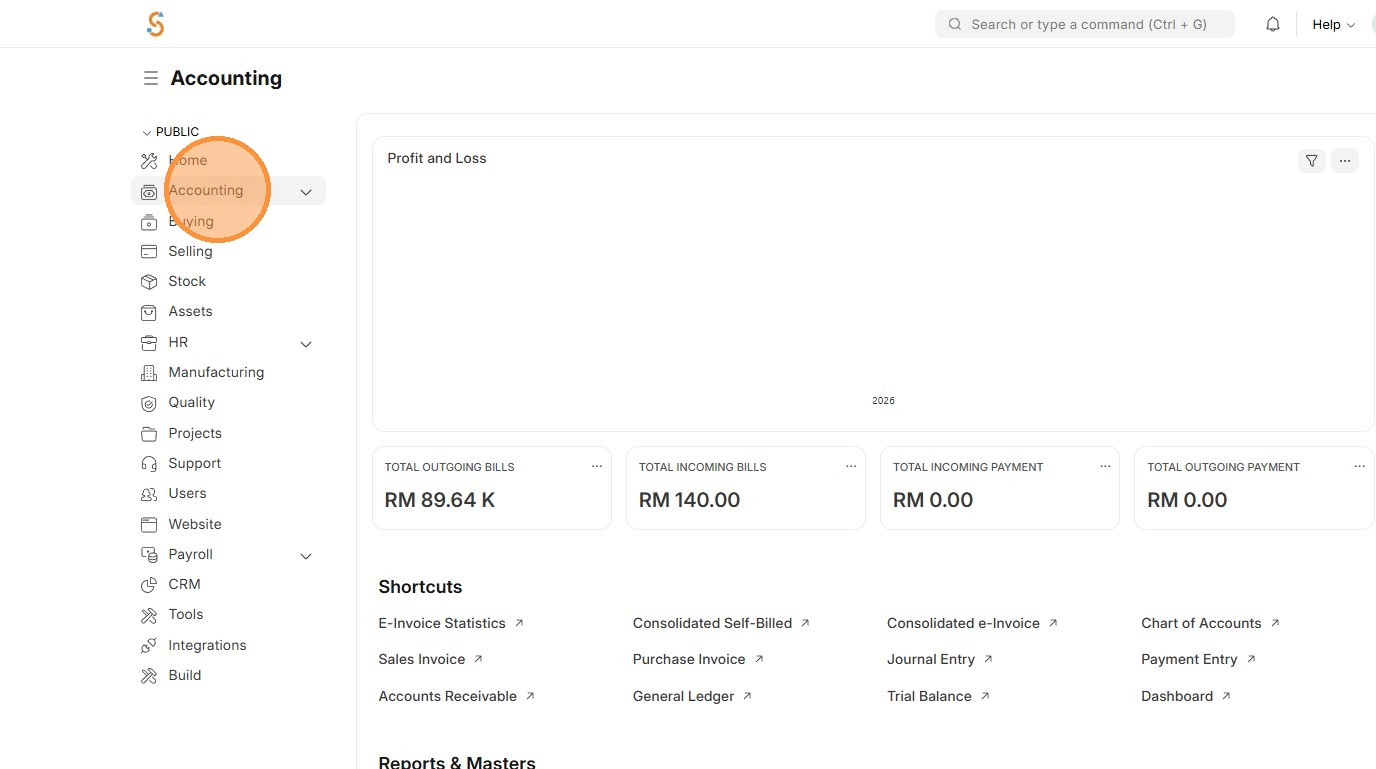

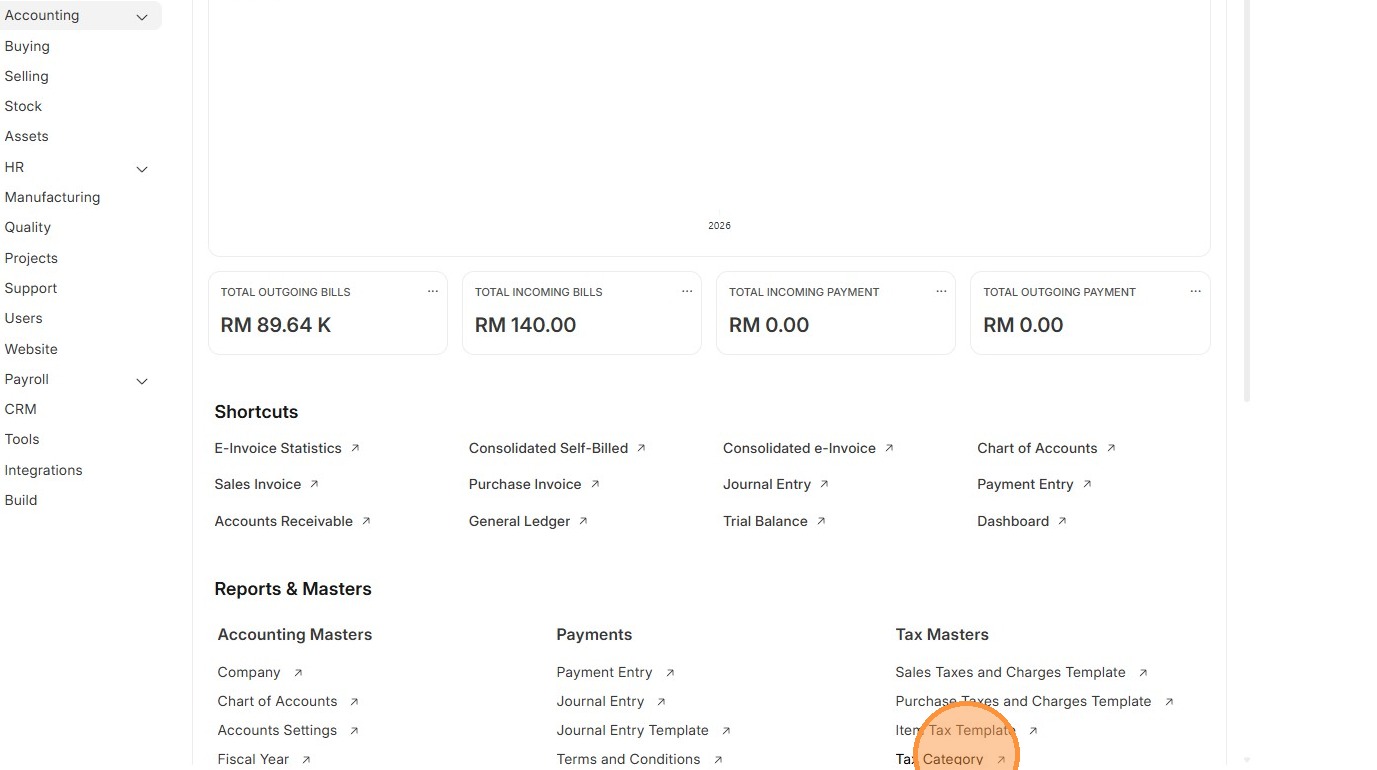

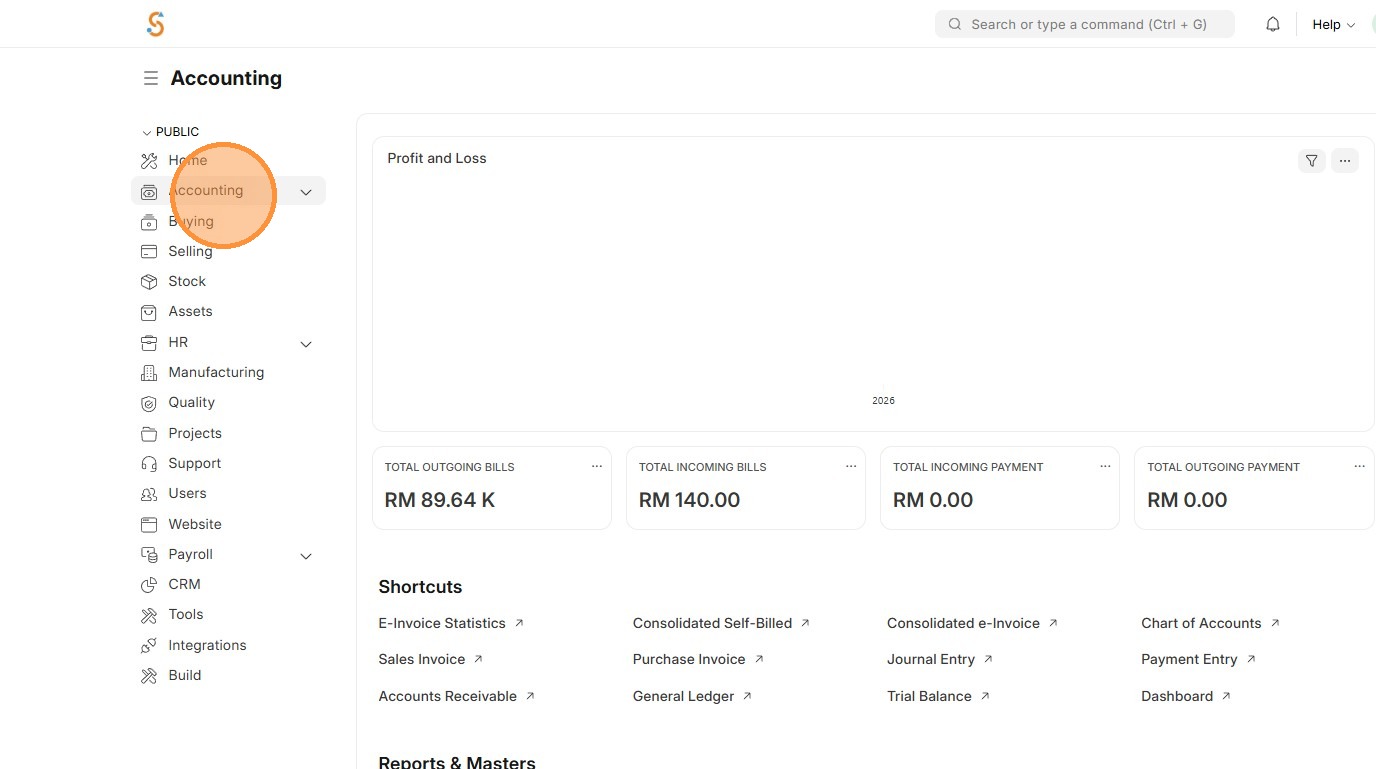

1. Click "Accounting"

2. Click "Tax Category"

3. Click "Add Tax Category"

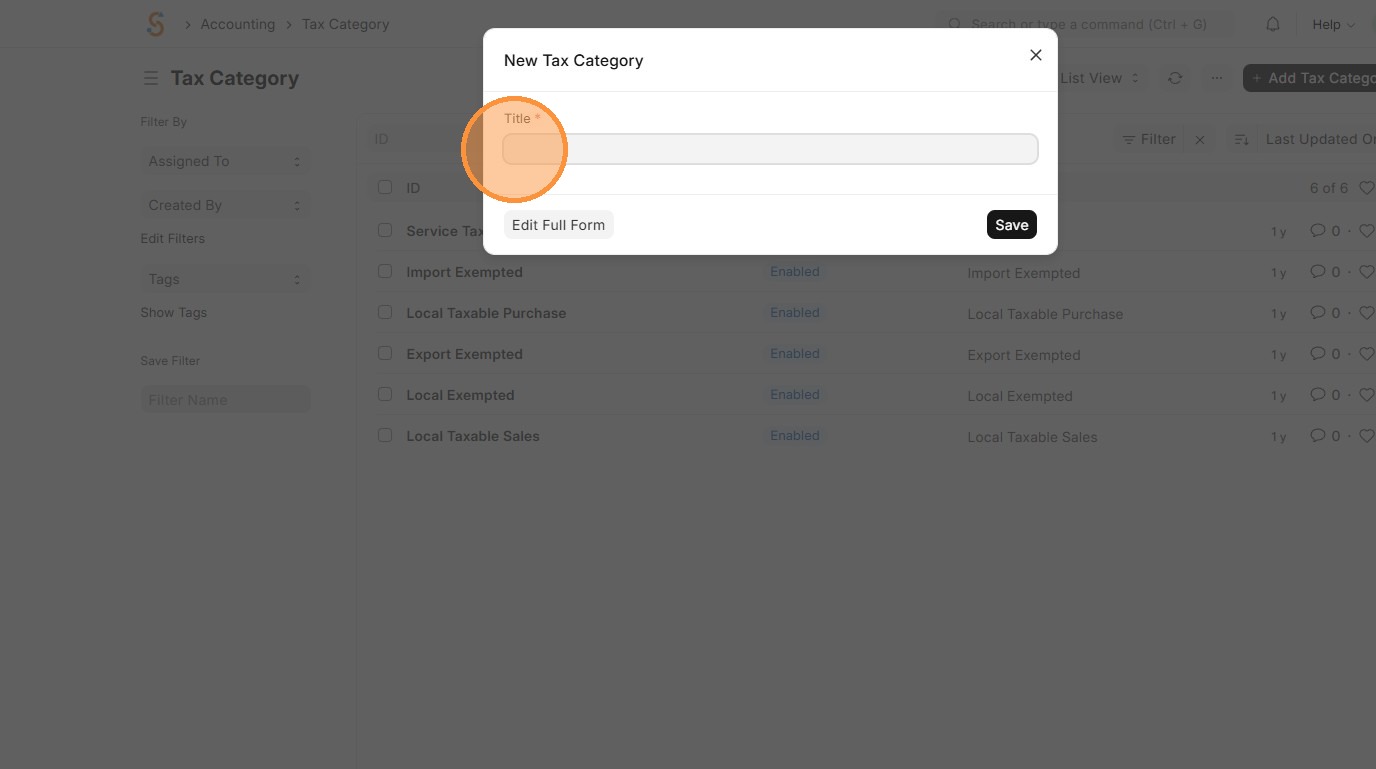

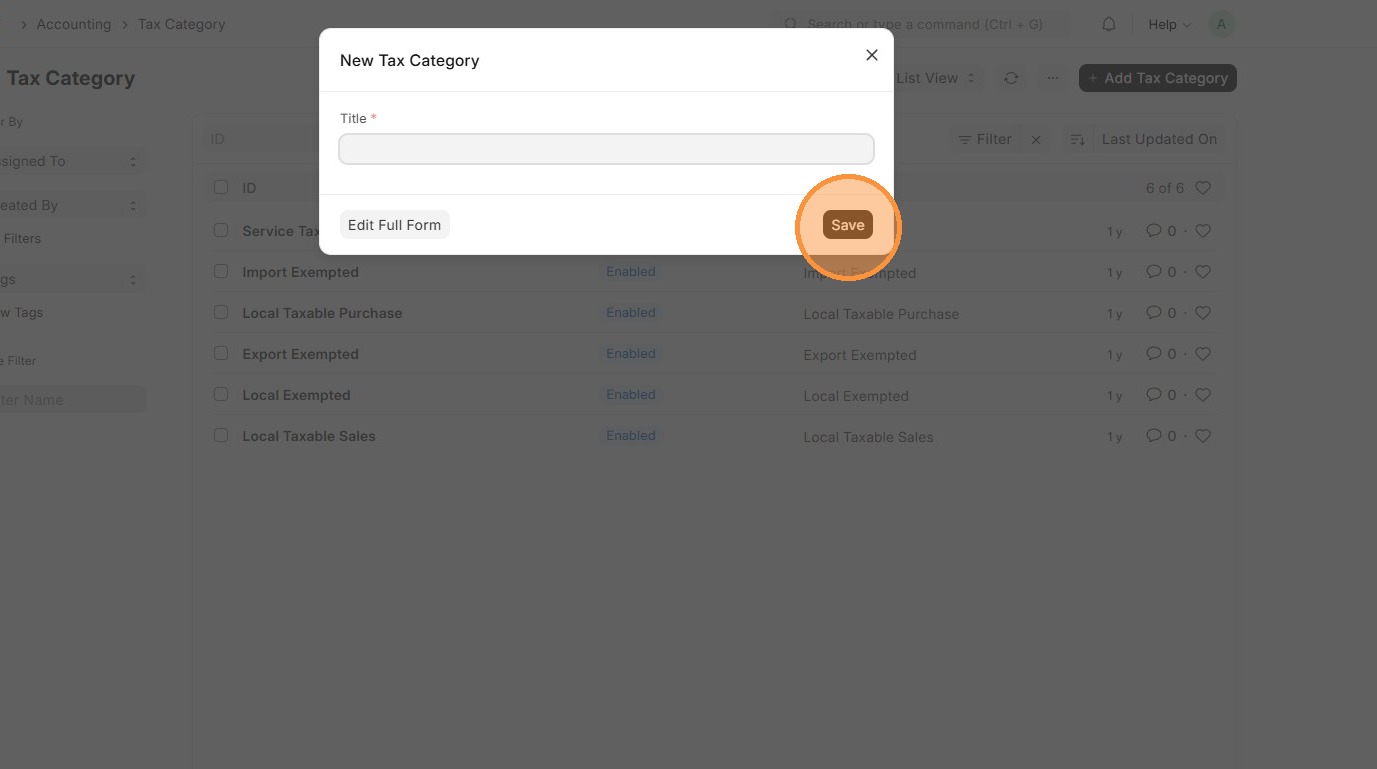

4. Enter Tax Category.

5. Click "Save"

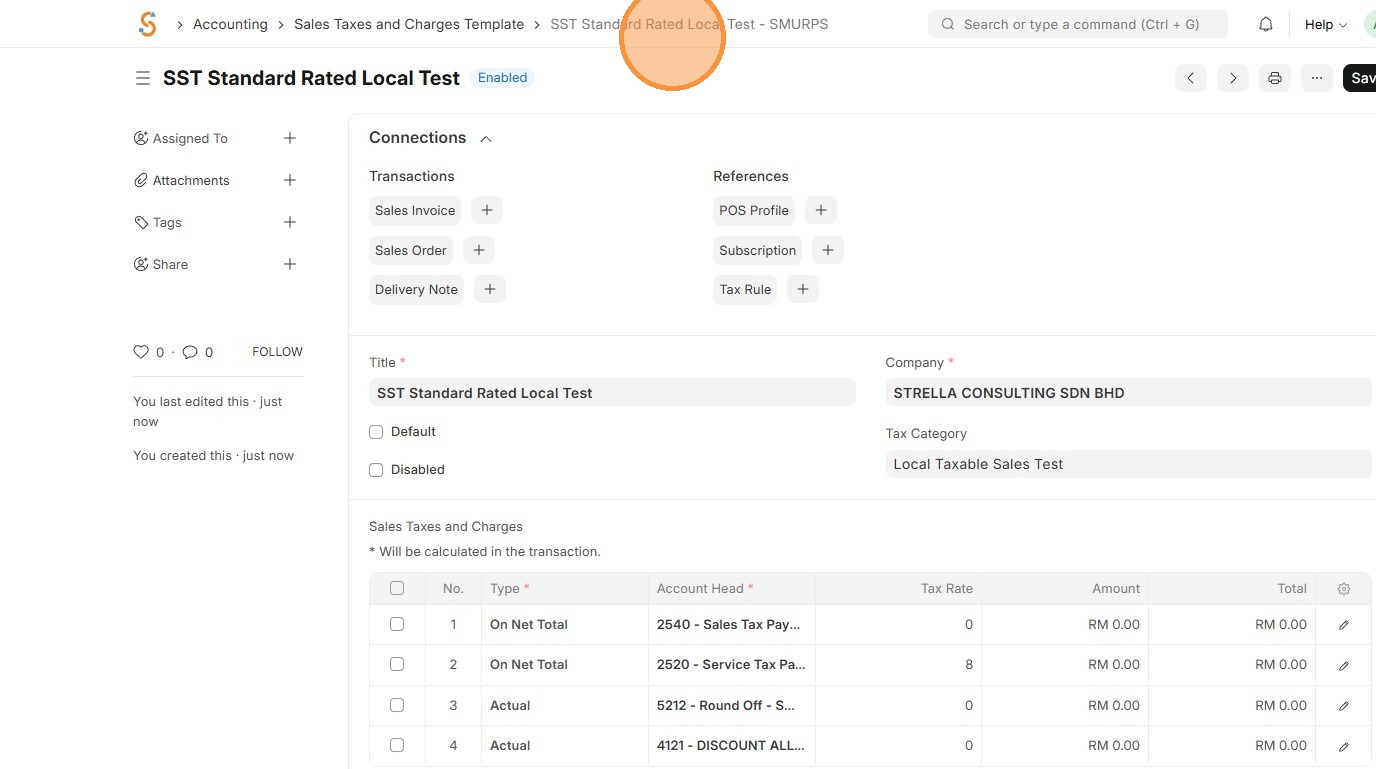

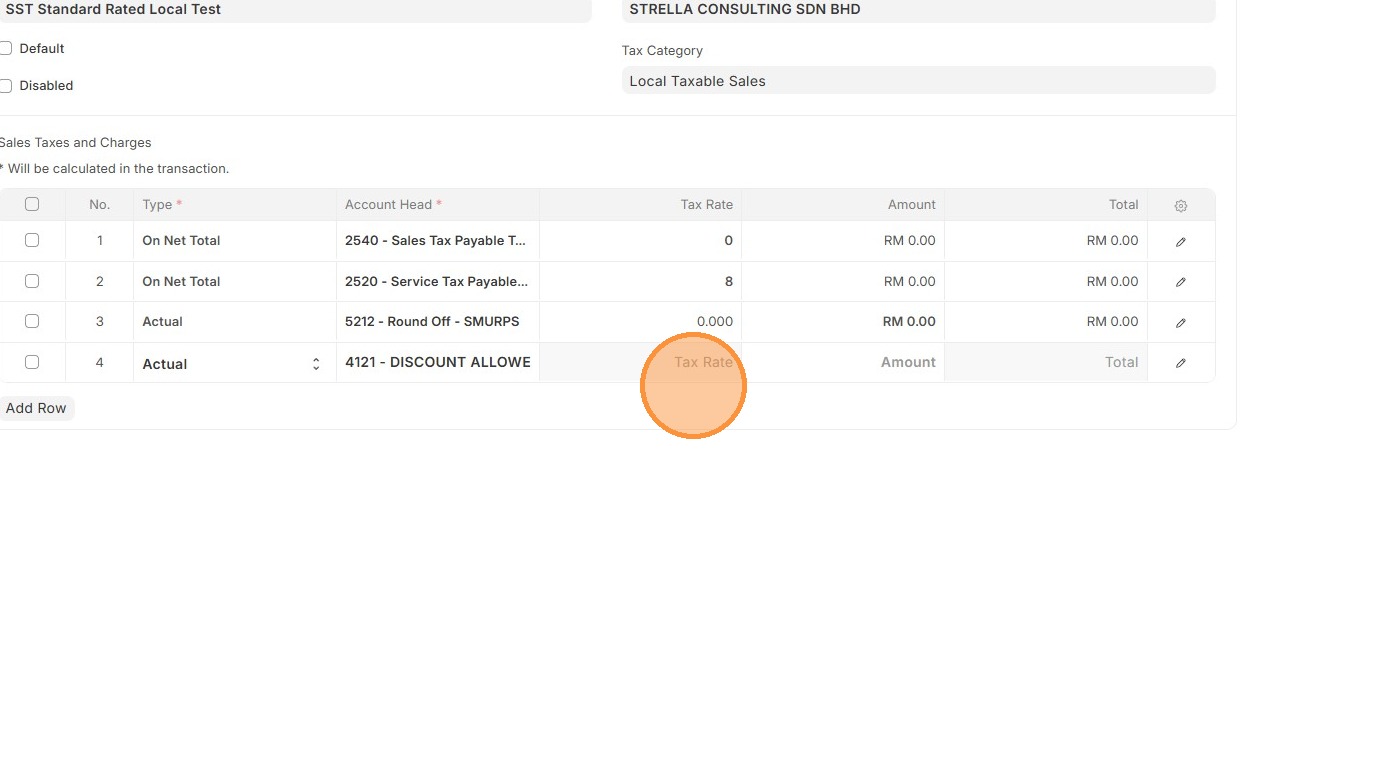

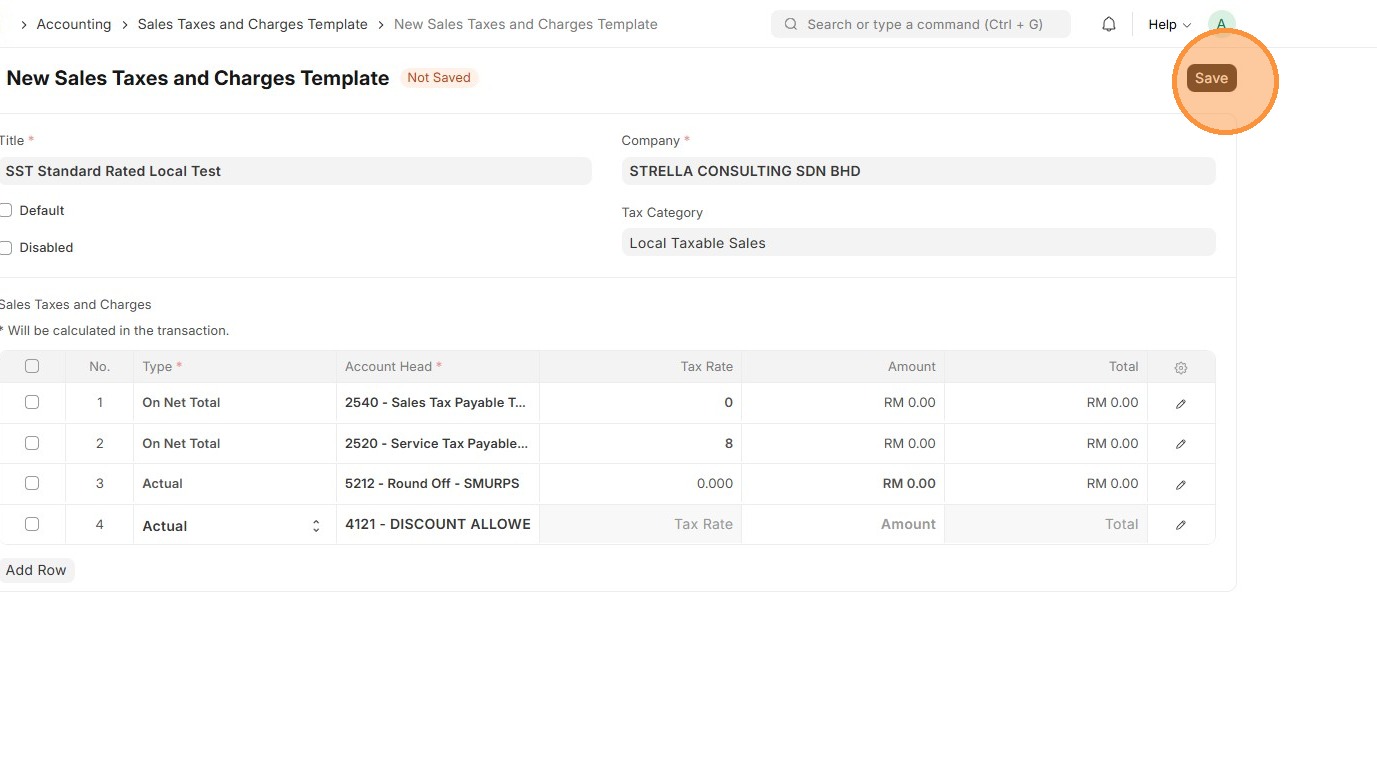

Sales Taxes and Charges Template

A Sales Taxes and Charges Template defines the taxes or extra charges that are applied automatically on a sales invoice. It ensures the right tax is added to each sale and posts it to the correct account for accurate accounting and reporting.

1. Click "Accounting"

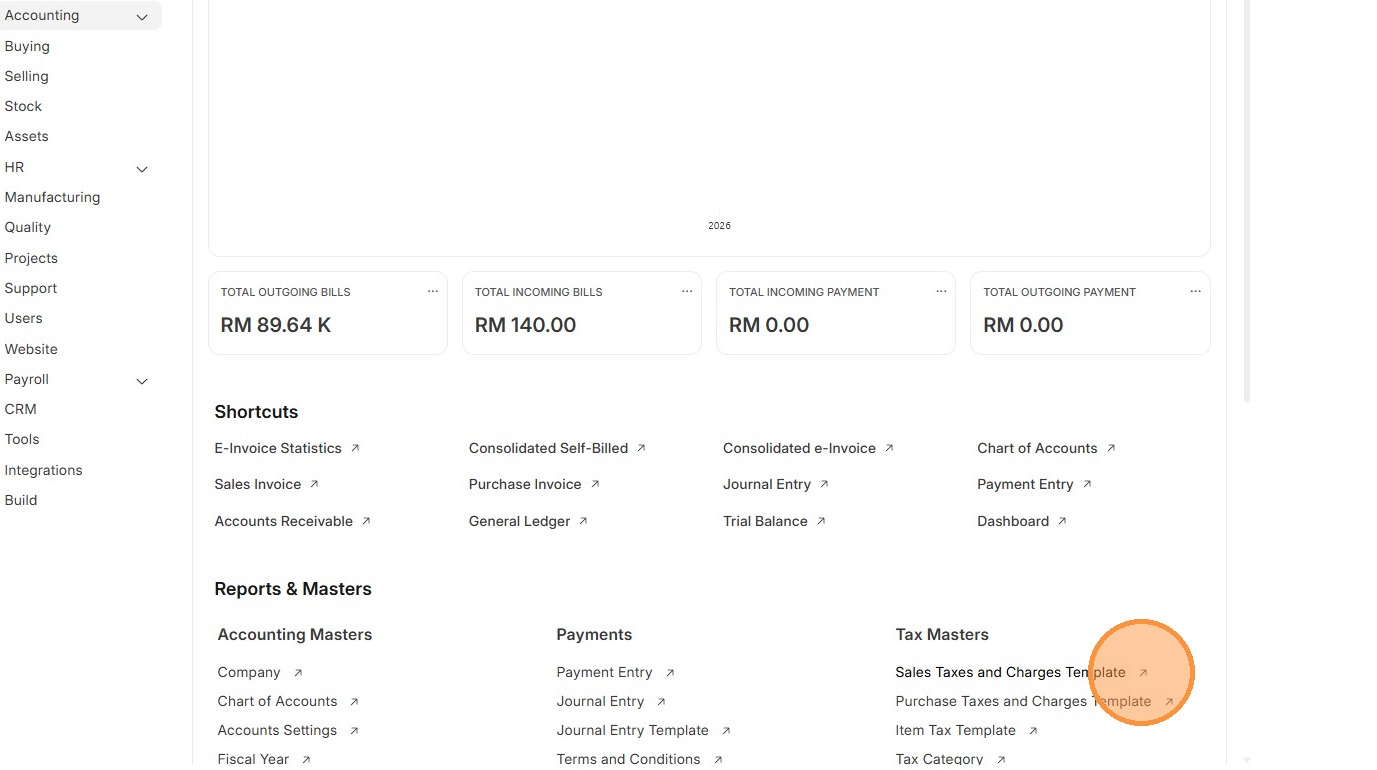

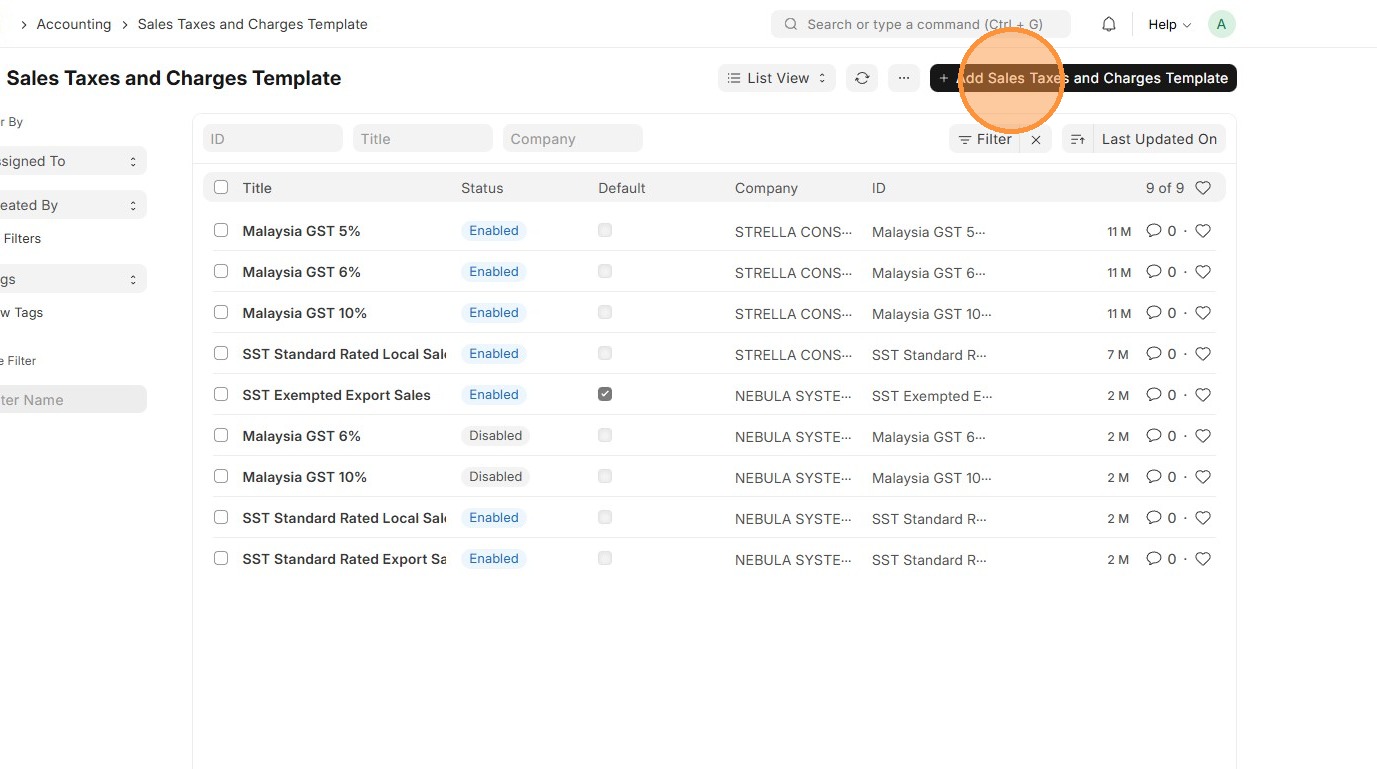

2. Click Sales Taxes and Charges Template.

3. Click "Add Sales Taxes and Charges Template"

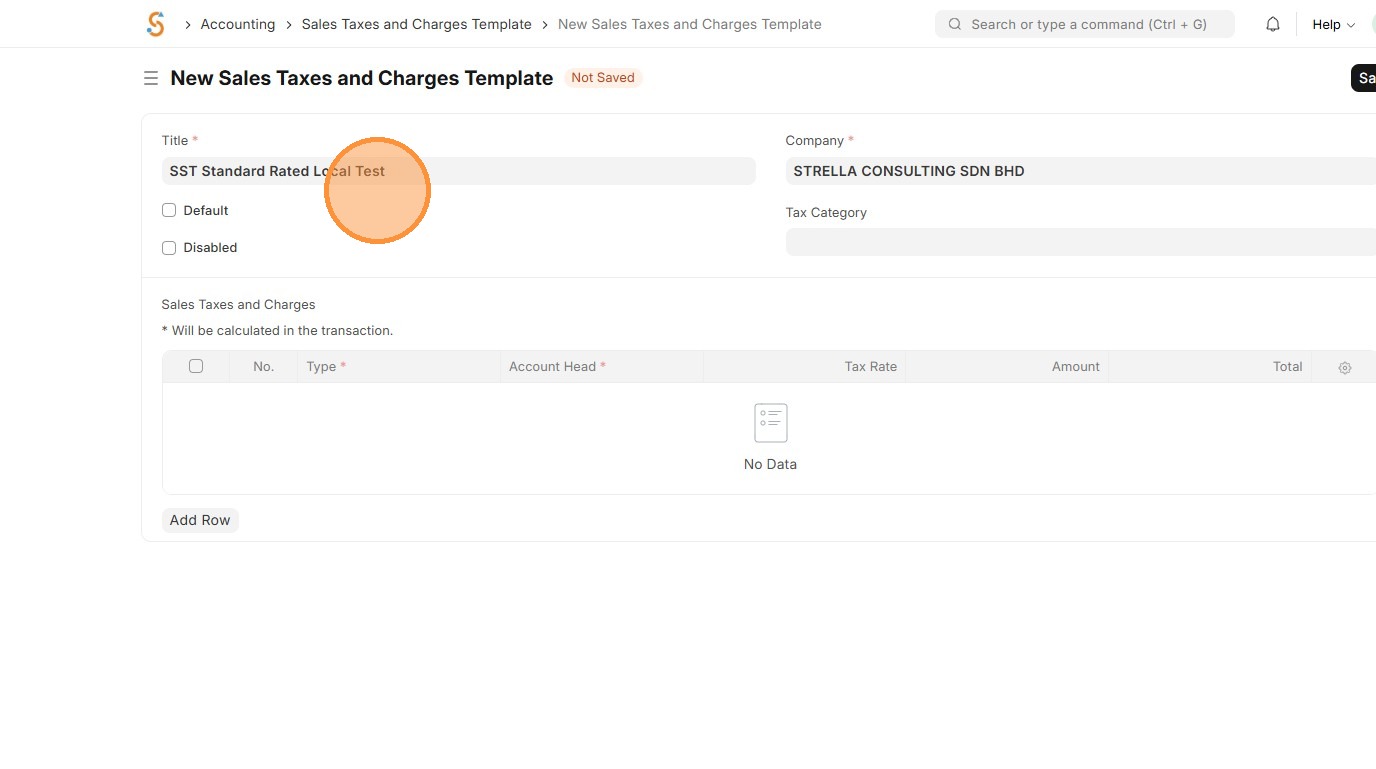

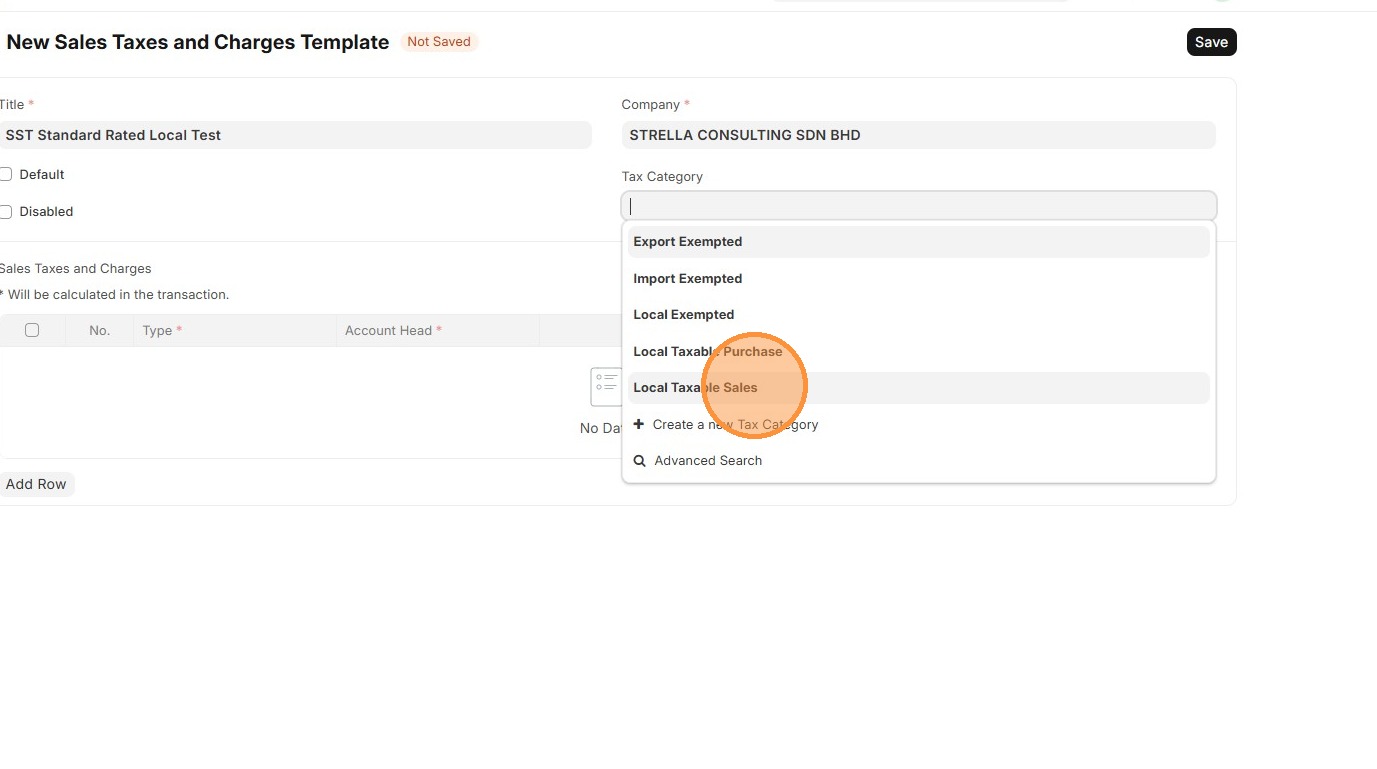

4. Enter Sales Taxes and Charges Template "Title"

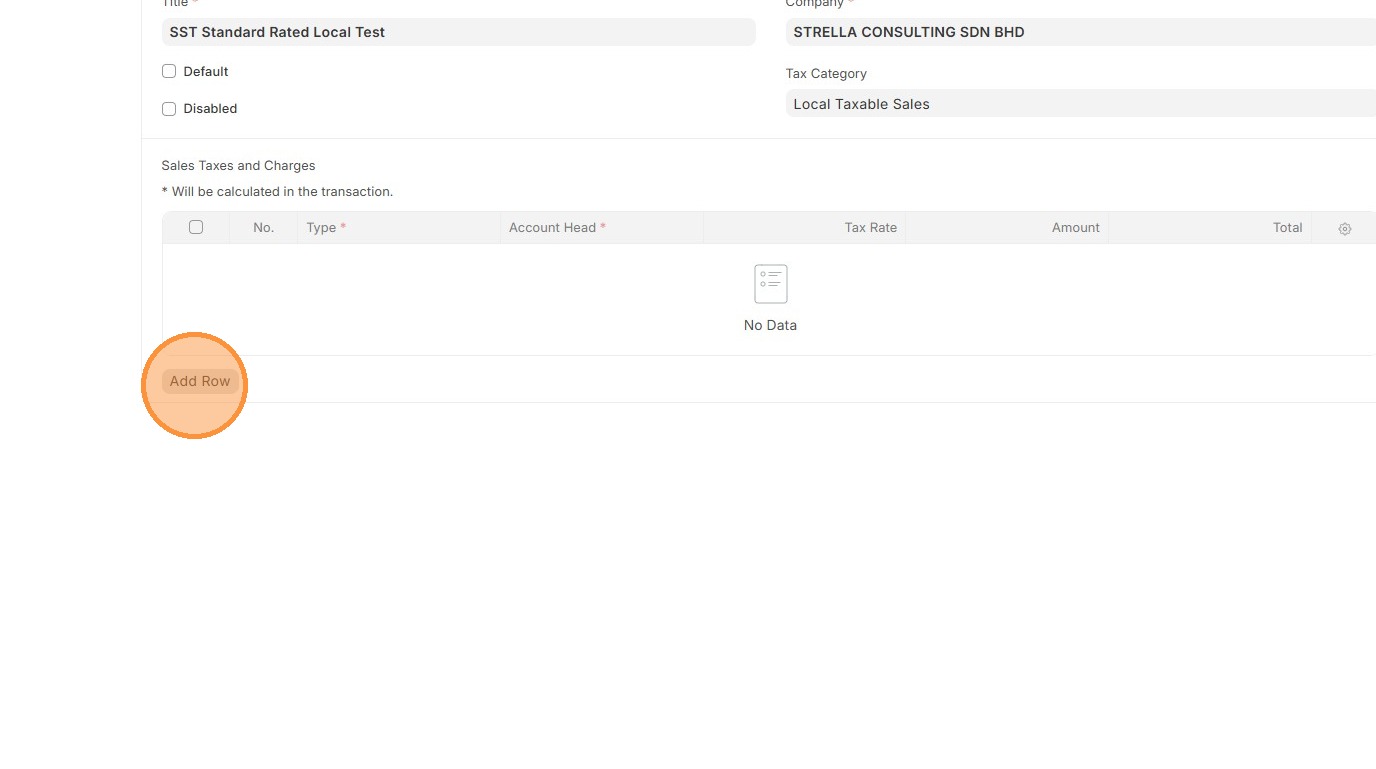

5. Select "Tax Category"

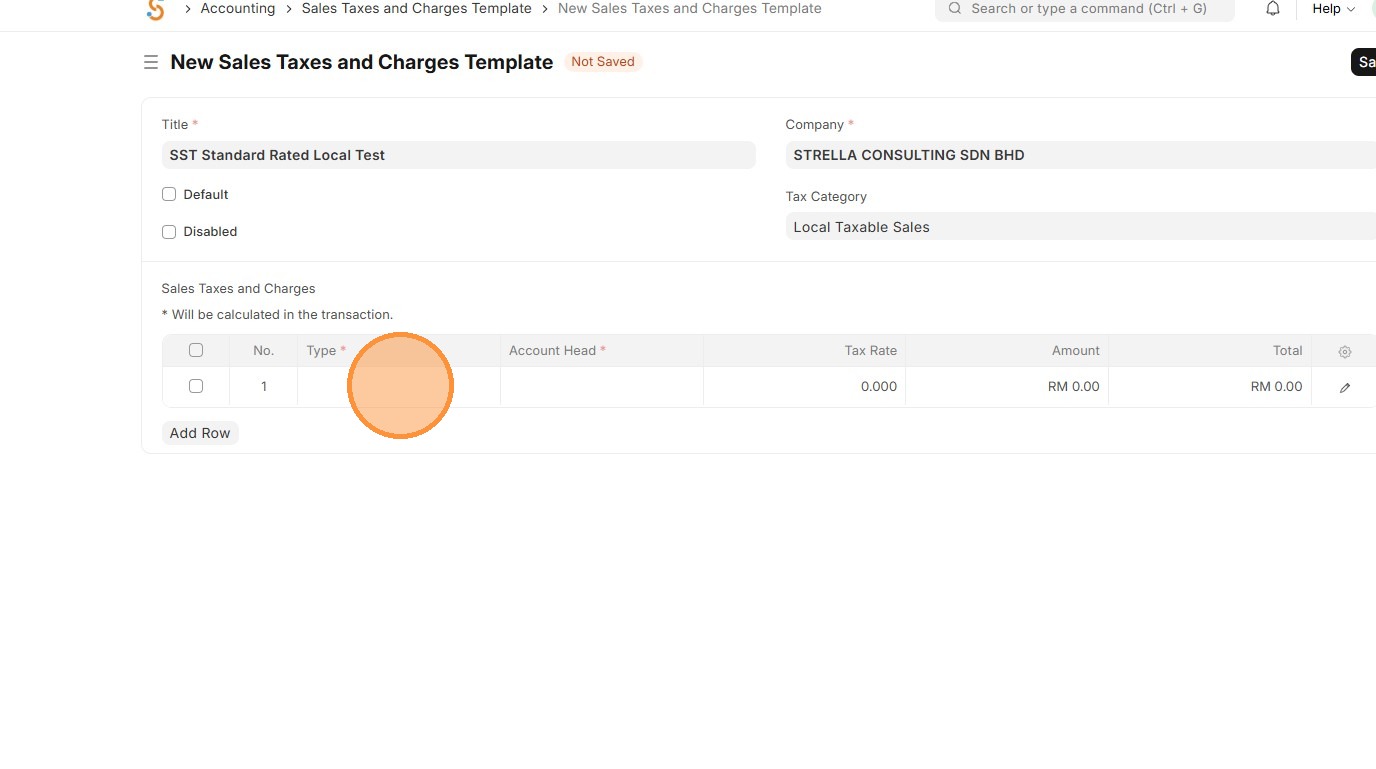

6. Click "Add Row"

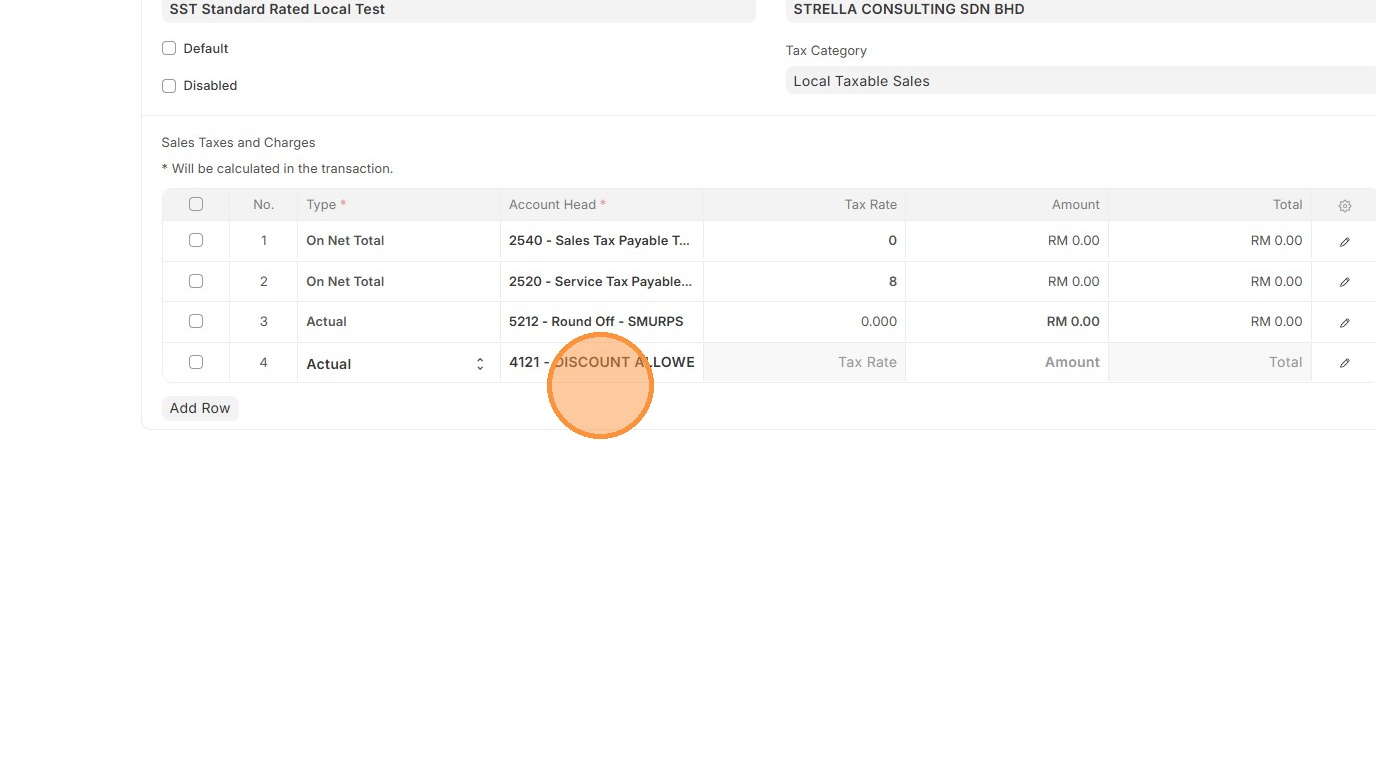

7. Select "Type".

On Net Total - Tax on total of items

On Previous Row Total - Tax on cumulative total up to another row

Actual - Fixed amount instead of percentage

On Item Quantity - Tax per unit quantity

8. Select the appropriate "Account Head" that is linked to the payment account.

9. Verify that "Tax Rate" is fetched accordingly based on Item Tax Template.

10. Click "Save"

11. Verify that Sales Taxes and Charges Template ID is created correctly.