SST Overview

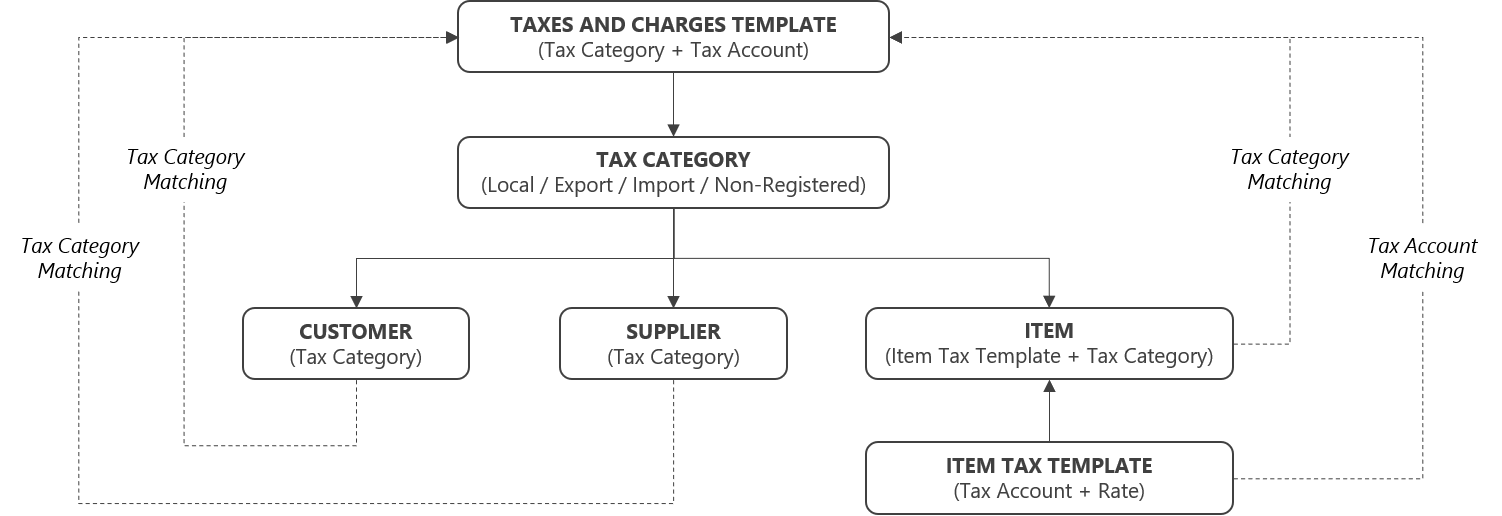

Tax Structure

The main components that form the Taxes and Charges function in the system are the Tax Category and Item Tax Template.

- Tax Categories are used to define the different tax scenarios and can be assigned to a specific Customer, Supplier or Item

- Item Tax Templates are used to set the applicable Tax Rate for a particular Tax Account and can be assigned to a specific Item

- Taxes and Charges Templates are used to define the different taxes and charges required for a particular Tax Category

Tax Data Mapping

SMURPS: Accounting > Taxes > Tax Category

SMURPS: Accounting > Taxes > Item Tax Template

SMURPS: Accounting > Taxes > Purchase Taxes and Charges Template

SMURPS: Accounting > Taxes > Sales Taxes and Charges Template

The application of the Malaysian Sales and Service Tax (SST) should be automated in any purchase or sales transaction based on the mapping in the table below.

| TAXES AND CHARGES TEMPLATE | PARTY TAX CATEGORY | ITEM TAX TEMPLATE | ITEM TAX CATEGORY |

TAX RATE |

SCENARIO |

| SST Standard Rated Purchase | Local Taxable Purchase |

Buying TX Sales |

Local Taxable Purchase | 5%, 10% | Buy Taxable Goods from Local Registered Supplier |

| Buying TX Service | Local Taxable Purchase | 8%, 6% | Buy Taxable Services from Local Registered Supplier | ||

| Buying ZR Sales | Local Taxable Purchase | 0% | Buy Non-Taxable Goods from Local Registered Supplier | ||

| Buying ZR Service | Local Taxable Purchase | 0% | Buy Non-Taxable Services from Local Registered Supplier | ||

| SST Non-Registered Purchase | Local Exempted | Buying NR Sales | Local Exempted | 0% | Buy Taxable/Non-Taxable Goods from Local Non-Registered Supplier *All product items |

| Buying NR Service | Local Exempted | 0% | Buy Taxable/Non-Taxable Services from Local Non-Registered Supplier *All service items |

||

| SST Exempted Import Purchase | Import Exempted | Buying IM Sales | Import Exempted | 0% | Buy Taxable/Non-Taxable Goods from Foreign Supplier *All product items |

| Buying IM Service | Import Exempted | 0% | Buy Taxable/Non-Taxable Services from Foreign Supplier *All service items |

||

| SST Standard Rated Local Sales | Local Taxable Sales | Selling TX Sales | Local Taxable Sales | 5%, 10% | Sell Taxable Goods to Local Customer |

| Selling TX Service | Local Taxable Sales | 8%, 6% | Sell Taxable Services to Local Customer | ||

| Selling ZR Sales | Local Taxable Sales | 0% | Sell Non-Taxable Goods to Local Customer | ||

| Selling ZR Service | Local Taxable Sales | 0% | Sell Non-Taxable Services to Local Customer | ||

| SST Standard Rated Export Sales | Local Taxable Sales | Selling TX Sales | Local Taxable Sales | 5%, 10% | Sell Taxable Goods to Foreign Customer |

| Selling TX Service | Local Taxable Sales | 8%, 6% | Sell Taxable Services to Foreign Customer | ||

| Selling ZR Sales | Local Taxable Sales | 0% | Sell Non-Taxable Goods to Foreign Customer | ||

| Selling ZR Service | Local Taxable Sales | 0% | Sell Non-Taxable Services to Foreign Customer | ||

| SST Exempted Export Sales | Export Exempted | Selling EX Sales | Export Exempted | 0% | Sell Taxable/Non-Taxable Goods to Foreign Customer *All product items |

| Selling EX Service | Export Exempted | 0% | Sell Taxable/Non-Taxable Services to Foreign |

Item Tax Data Maintenance

SMURPS: Stock > Items and Pricing > Item

The Item Tax Template and Item Tax Category assignment in the Item Master Data depends on the other attributes of the product.

- Purchase Item -This Item is purchased from a third-party Supplier and not manufactured

- Sales Item - This Item can be sold to Customers

- Applicable for Purchase Tax - This Item is subject to input tax if purchased from a SST-registered Supplier

- Applicable for Sales Tax - This Item is subject to output tax if sold to a local Customer

| NO. | PURCHASE ITEM |

SALES ITEM |

APPLICABLE FOR PURCHASE TAX |

APPLICABLE FOR SALES TAX |

ITEM TAX TEMPLATE | ITEM TAX CATEGORY |

| 1 | Yes | Yes | Yes | Yes | Buying TX Sales Buying NR Sales Buying IM Sales Selling TX Sales Selling EX Sales |

Local Taxable Purchase Local Exempted Import Exempted Local Taxable Sales Export Exempted |

| Buying TX Service Buying NR Service Buying IM Service Selling TX Service Selling EX Service |

Local Taxable Purchase Local Exempted Import Exempted Local Taxable Sales Export Exempted |

|||||

| 2 | Yes | Yes | Yes | No | Buying TX Sales Buying NR Sales Buying IM Sales Selling ZR Sales Selling EX Sales |

Local Taxable Purchase Local Exempted Import Exempted Local Taxable Sales Export Exempted |

| Buying TX Service Buying NR Service Buying IM Service Selling ZR Service Selling EX Service |

Local Taxable Purchase Local Exempted Import Exempted Local Taxable Sales Export Exempted |

|||||

| 3 | Yes | Yes | No | Yes | Buying ZR Sales Buying NR Sales Buying IM Sales Selling TX Sales Selling EX Sales |

Local Taxable Purchase Local Exempted Import Exempted Local Taxable Sales Export Exempted |

| Buying ZR Service Buying NR Service Buying IM Service Selling TX Service Selling EX Service |

Local Taxable Purchase Local Exempted Import Exempted Local Taxable Sales Export Exempted |

|||||

| 4 | Yes | Yes | No | No | Buying ZR Sales Buying NR Sales Buying IM Sales Selling ZR Sales Selling EX Sales |

Local Taxable Purchase Local Exempted Import Exempted Local Taxable Sales Export Exempted |

| Buying ZR Service Buying NR Service Buying IM Service Selling ZR Service Selling EX Service |

Local Taxable Purchase Local Exempted Import Exempted Local Taxable Sales Export Exempted |

|||||

| 5 | Yes | No | Yes | No | Buying TX Sales Buying NR Sales Buying IM Sales |

Local Taxable Purchase Local Exempted Import Exempted |

| Buying TX Service Buying NR Service Buying IM Service |

Local Taxable Purchase Local Exempted Import Exempted |

|||||

| 6 | Yes | No | No | No | Buying ZR Sales Buying NR Sales Buying IM Sales |

Local Taxable Purchase Local Exempted Import Exempted |

| Buying ZR Service Buying NR Service Buying IM Service |

Local Taxable Purchase Local Exempted Import Exempted |

|||||

| 7 | No | Yes | Yes | Yes | Selling TX Sales Selling EX Sales |

Local Taxable Sales Export Exempted |

| Selling TX Service Selling EX Service |

Local Taxable Sales Export Exempted |

|||||

| 8 | No | Yes | Yes | No | Selling ZR Sales Selling EX Sales |

Local Taxable Sales Export Exempted |

| Selling ZR Service Selling EX Service |

Local Taxable Sales Export Exempted |

SST Report

SMURPS: Sales and Service Tax Report SMURPS

To generate the SST Report, make the following selection and click Generate SST Report.

- Company - Company that is SST registered

- Document Type - Sales Invoice

- From Date - Start date of the SST reporting period, typically bi-monthly

- To Date - End date of the SST reporting period, typically bi-monthly

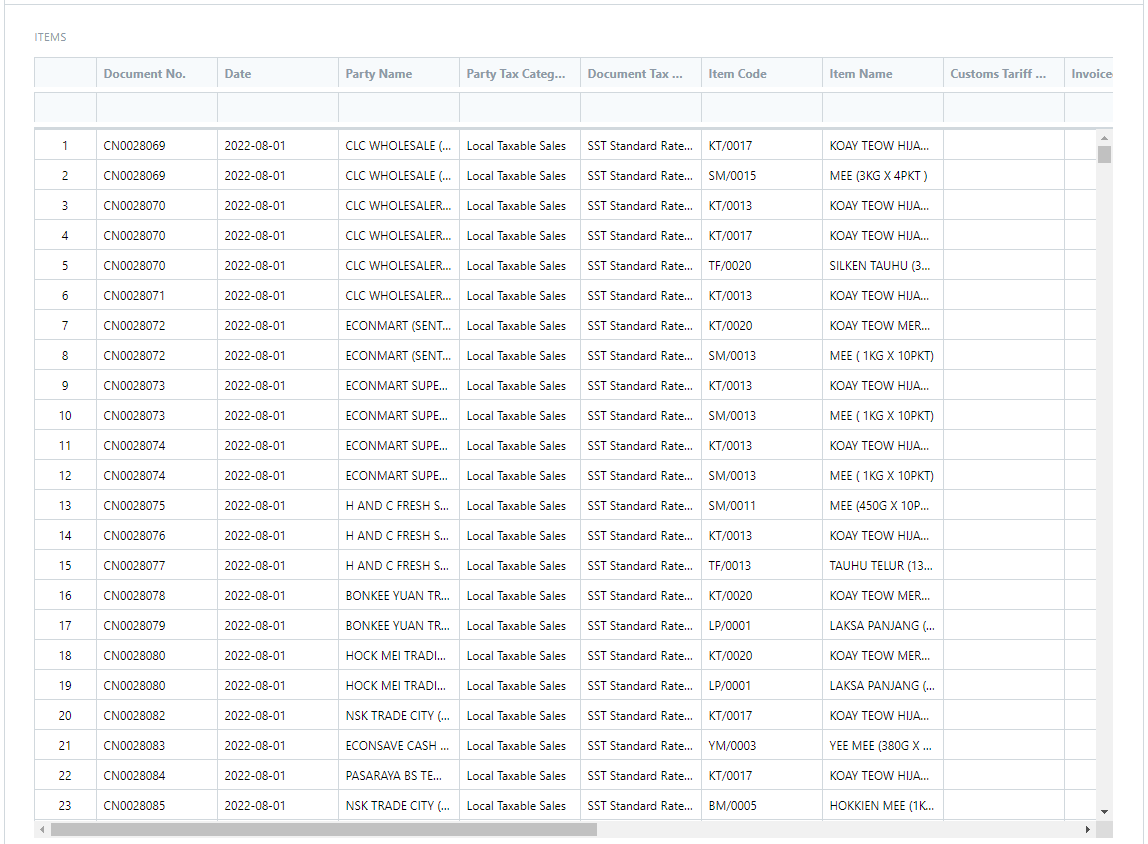

Items Section

Detailed breakdown of taxable Sales Invoice transactions by Item whereby the following fields are not blank: -

- Sales Taxes and Charges Template

- Tax Category

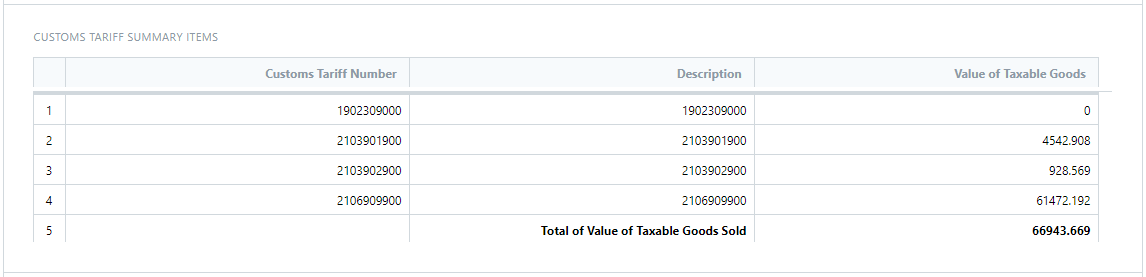

Customs Tariff Summary Items Section

Summarized information of the taxable Sales Invoice transactions by the Item Customs Tariff Number.

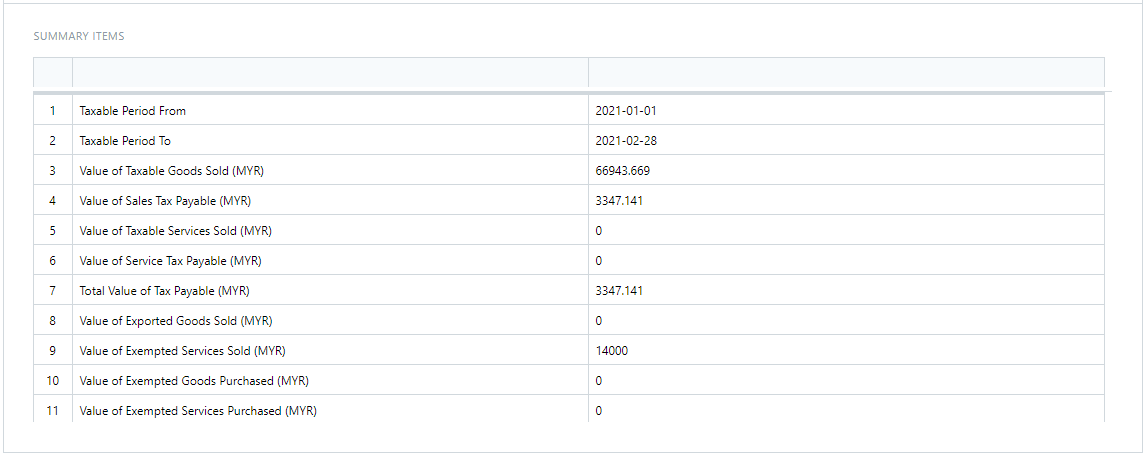

Summary Items Section

Summarized information of the taxable Sales Invoice transactions based on the Sales and Service Tax Configuration setup.

- Value of Taxable Goods Sold (MYR)

- Value of Sales Tax Payable (MYR)

- Value of Taxable Services Sold (MYR)

- Value of Service Tax Payable (MYR)

- Total Value of Tax Payable (MYR)

- Value of Exported Goods Sold (MYR)

- Value of Exempted Services Sold (MYR)

- Value of Exempted Goods Purchased (MYR)

- Value of Exempted Services Purchased (MYR)

No comments to display

No comments to display